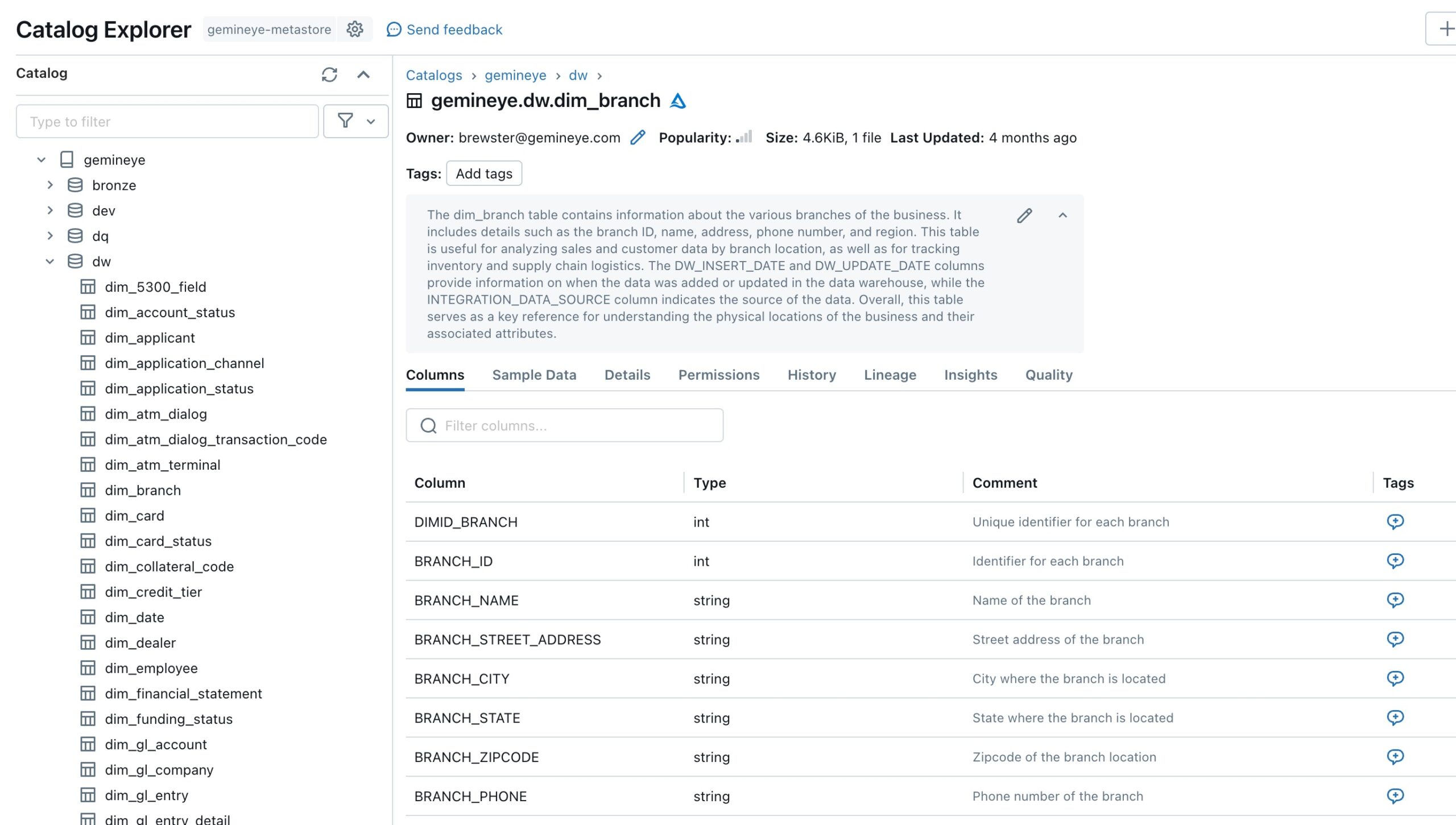

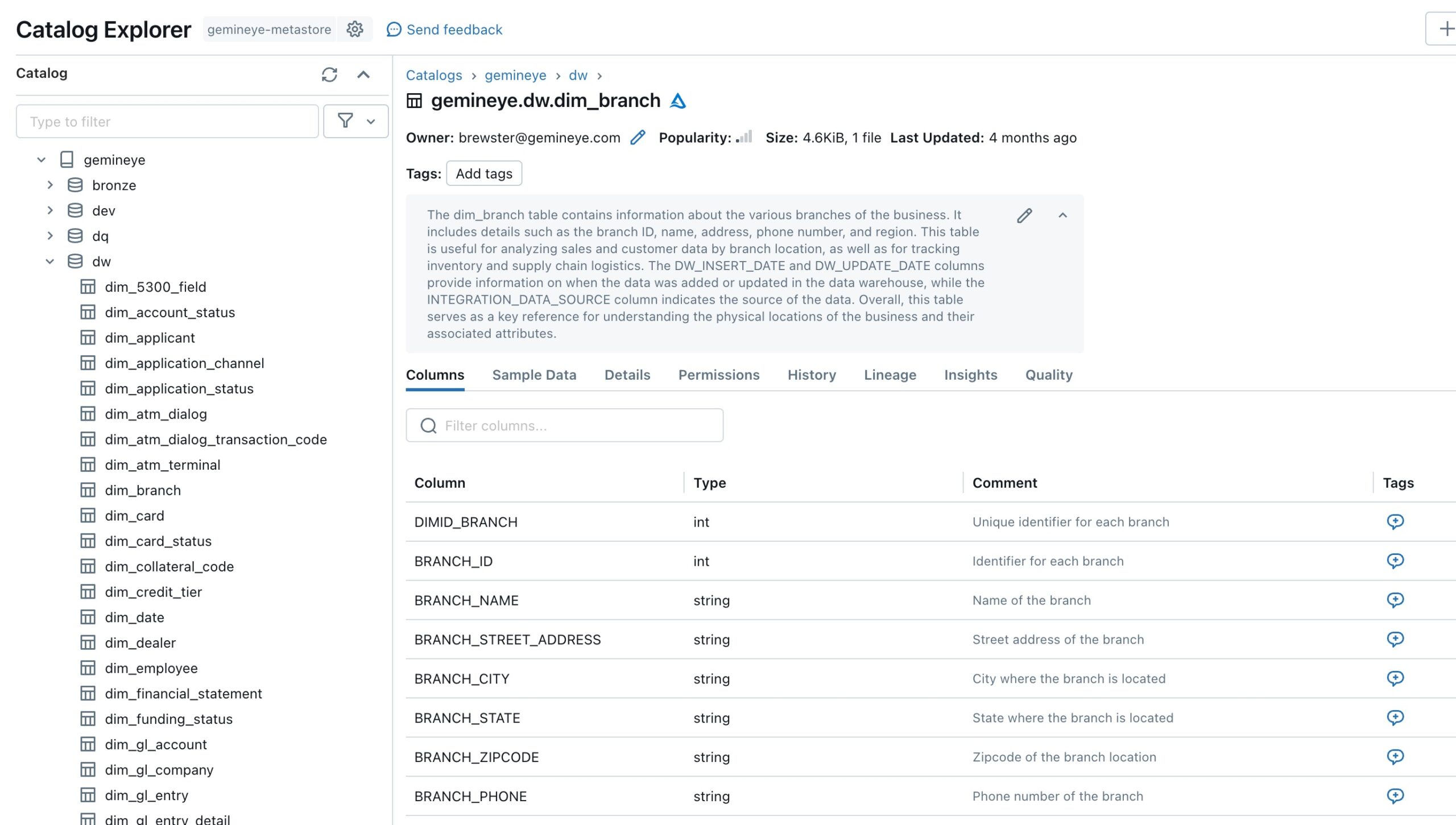

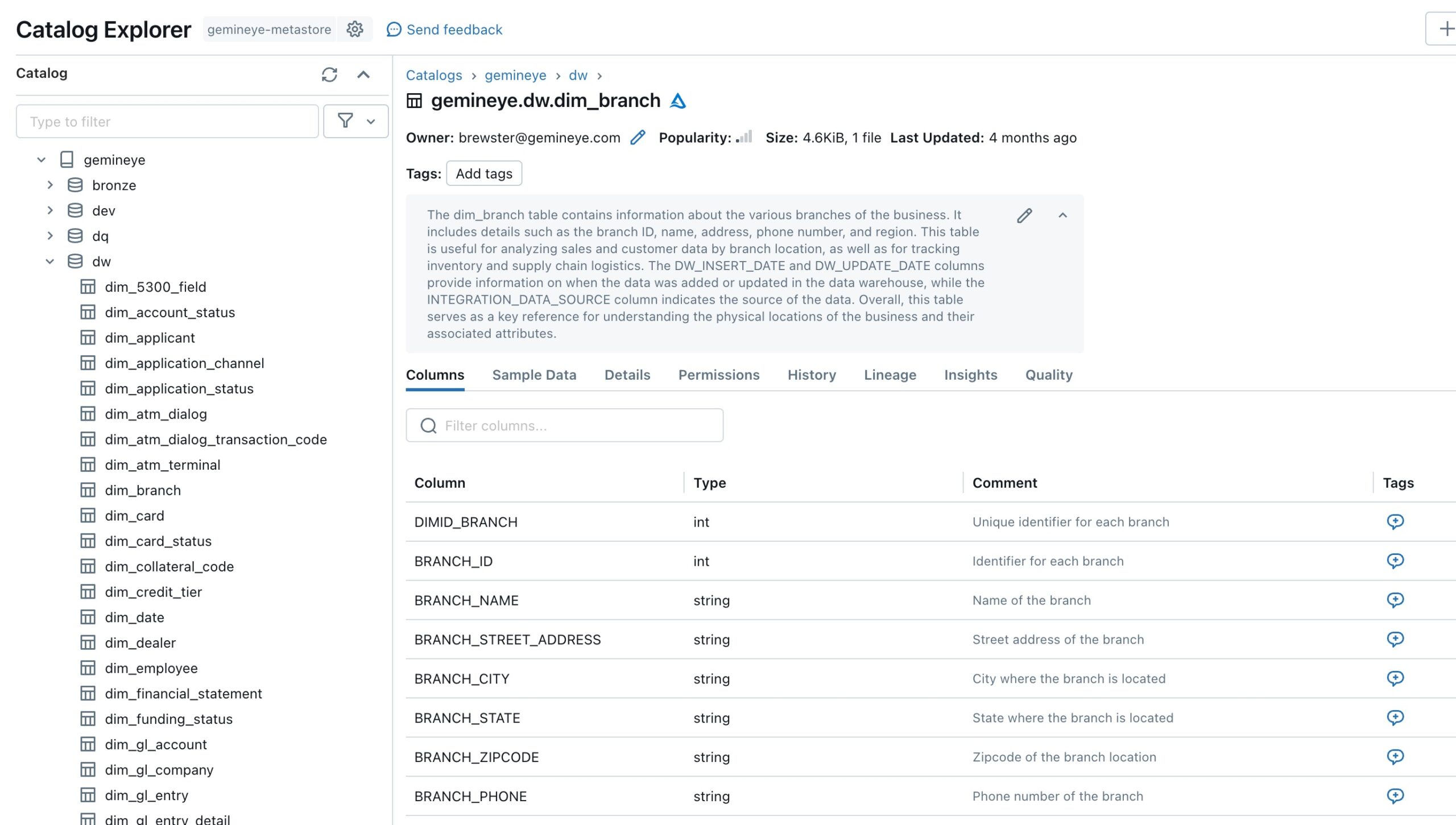

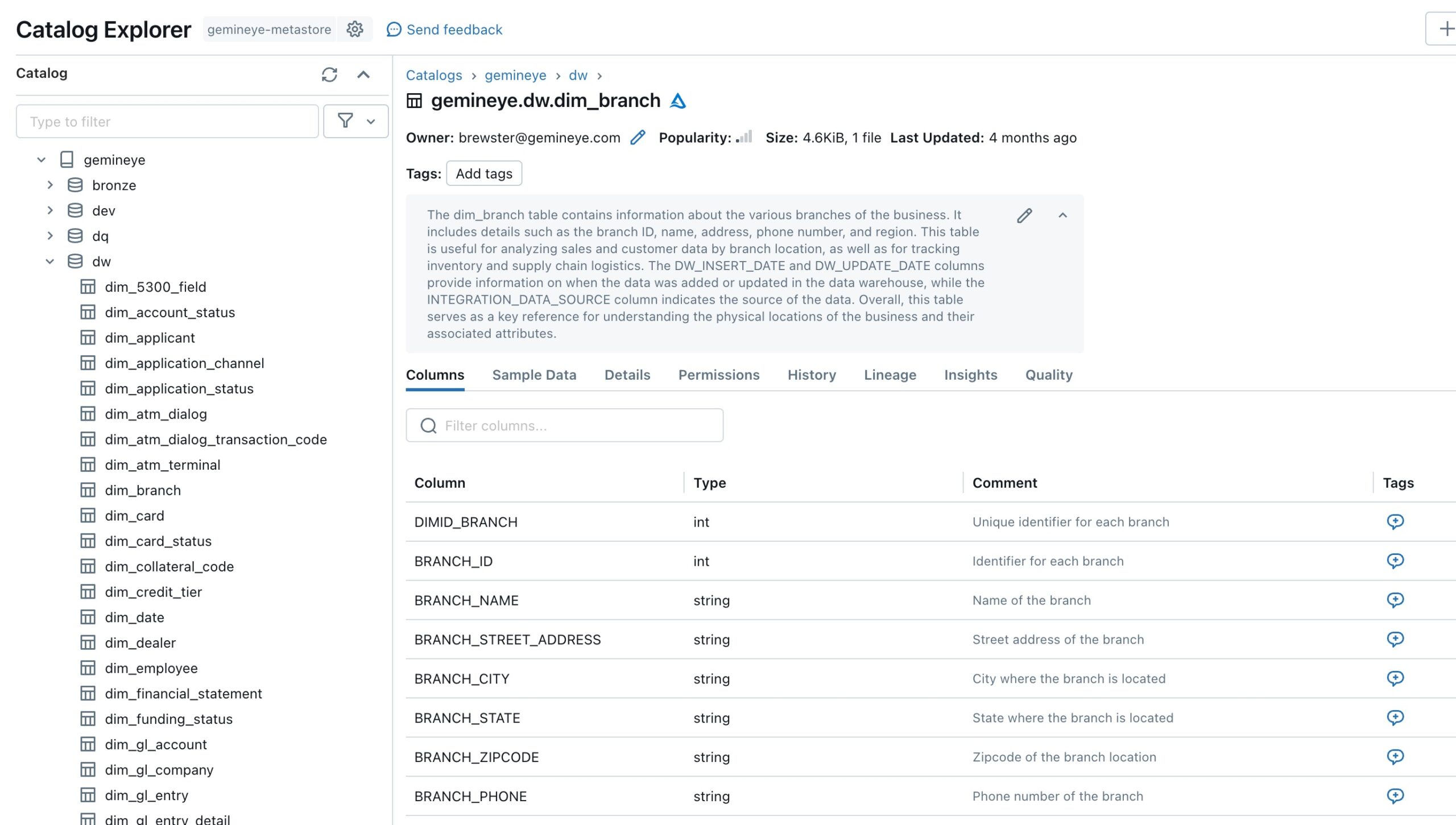

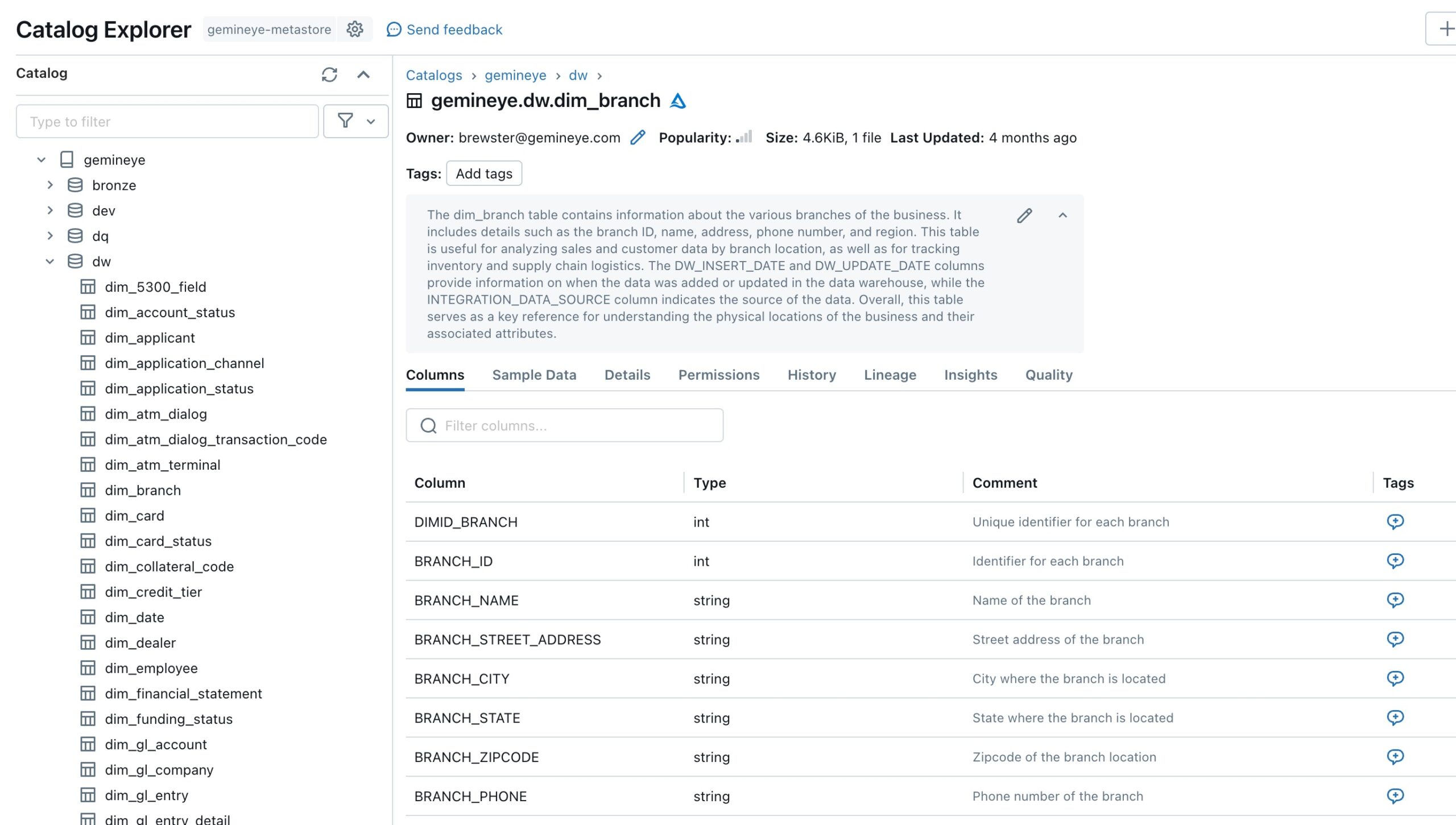

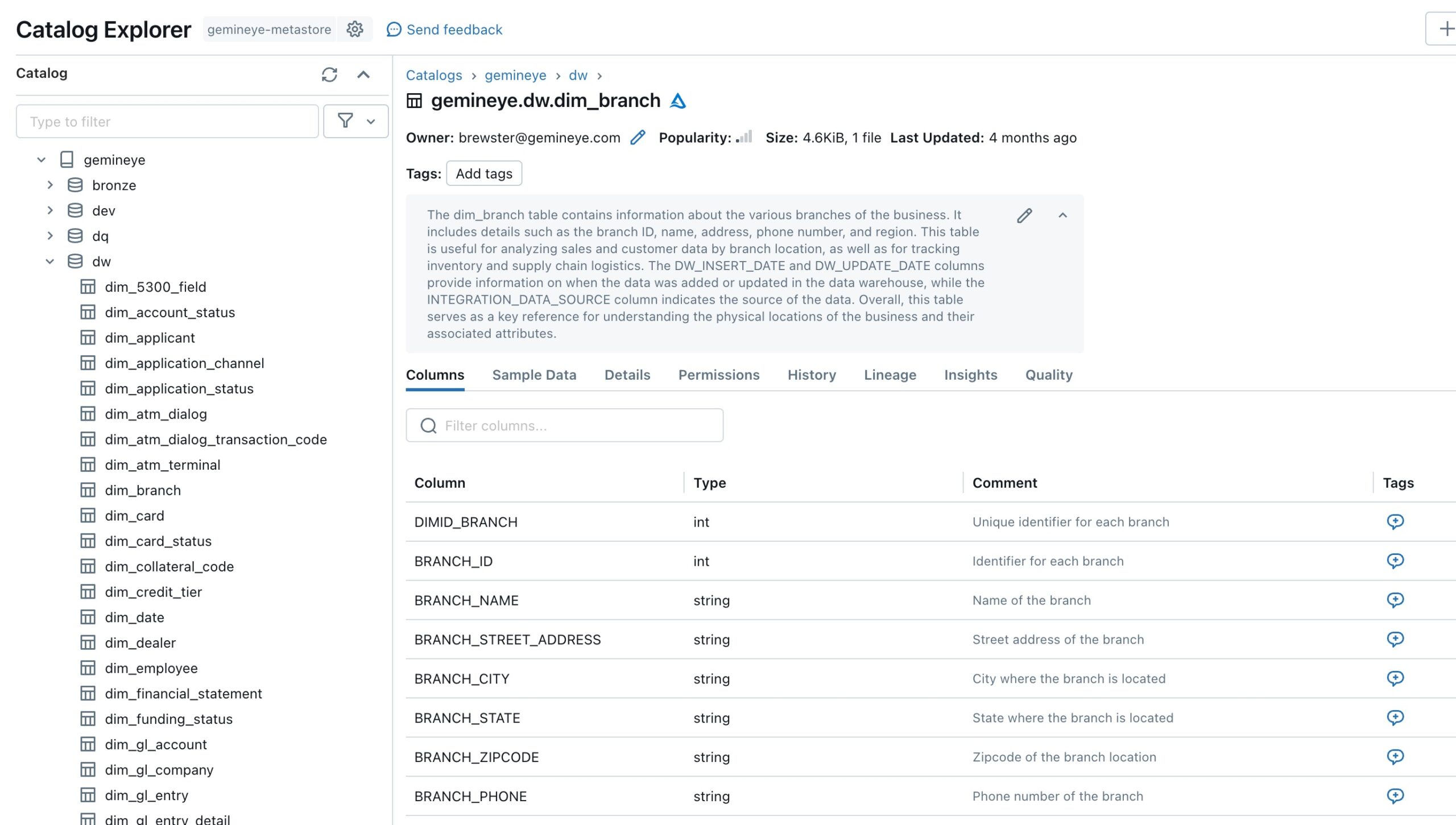

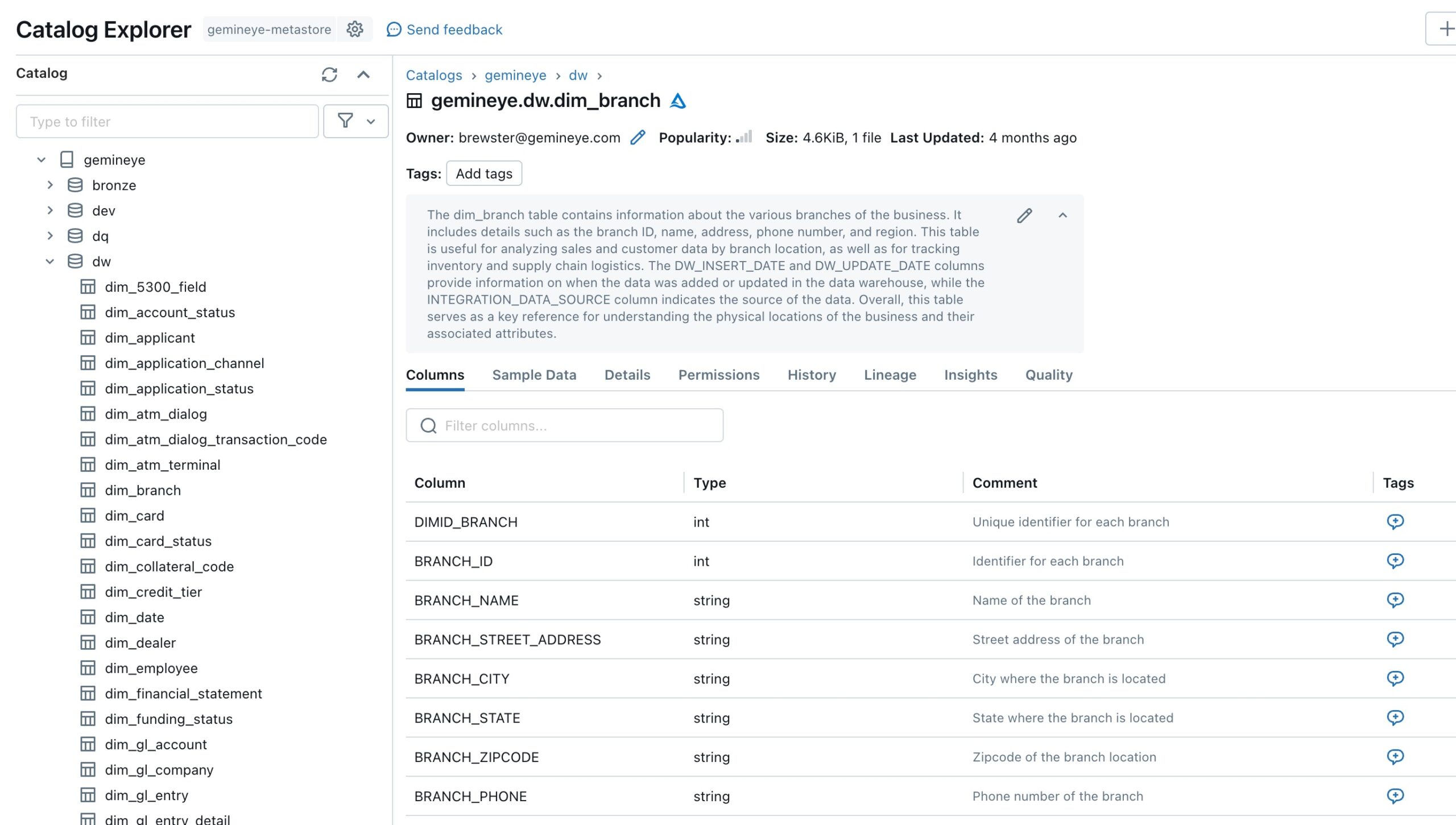

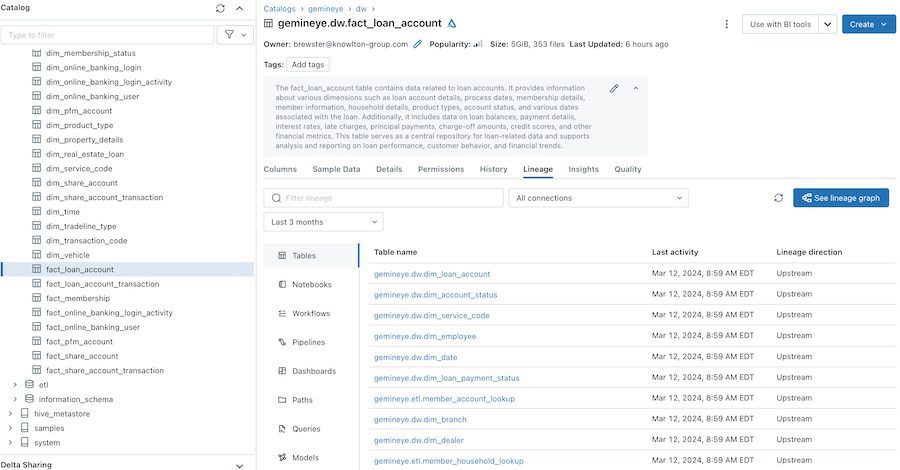

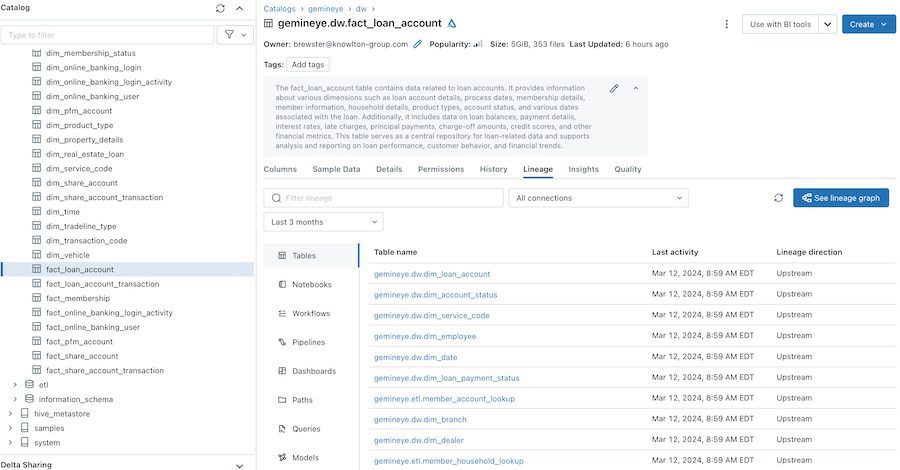

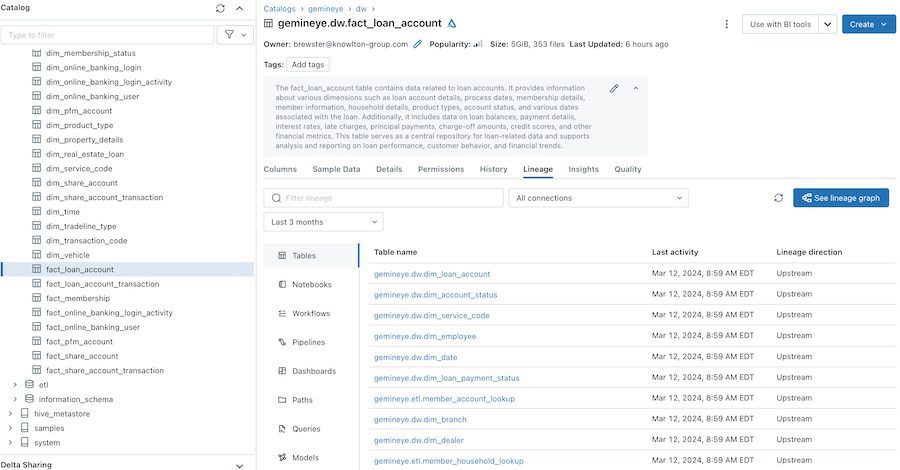

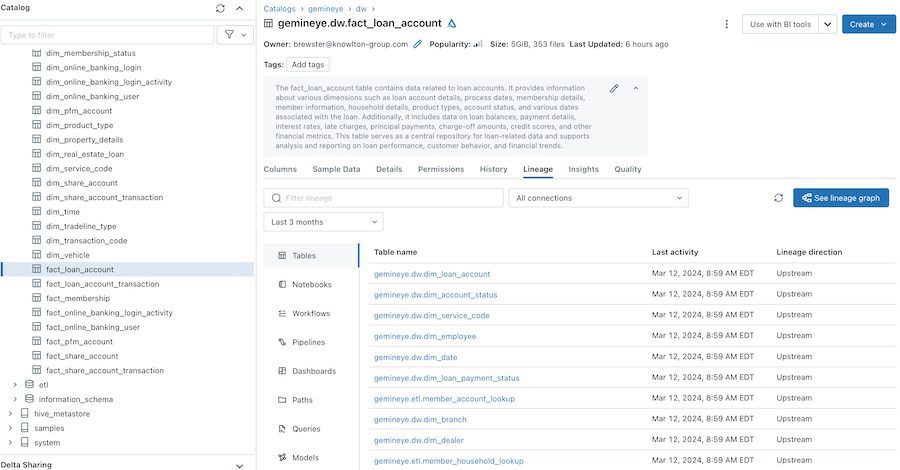

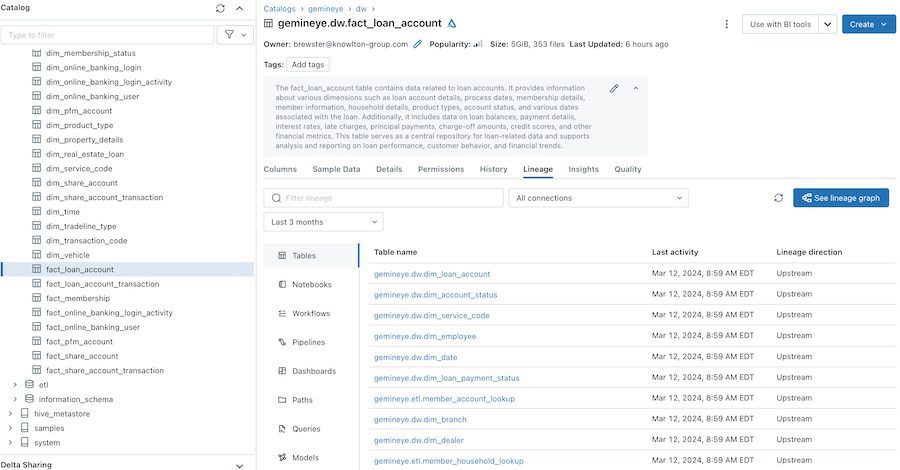

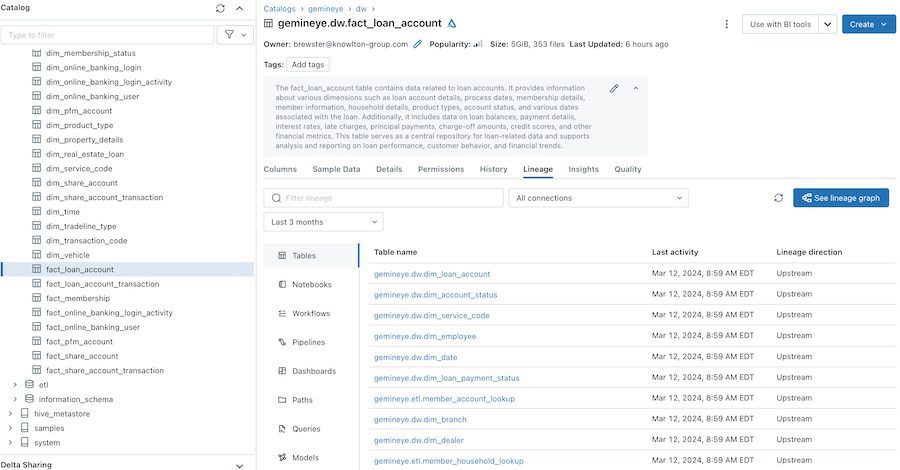

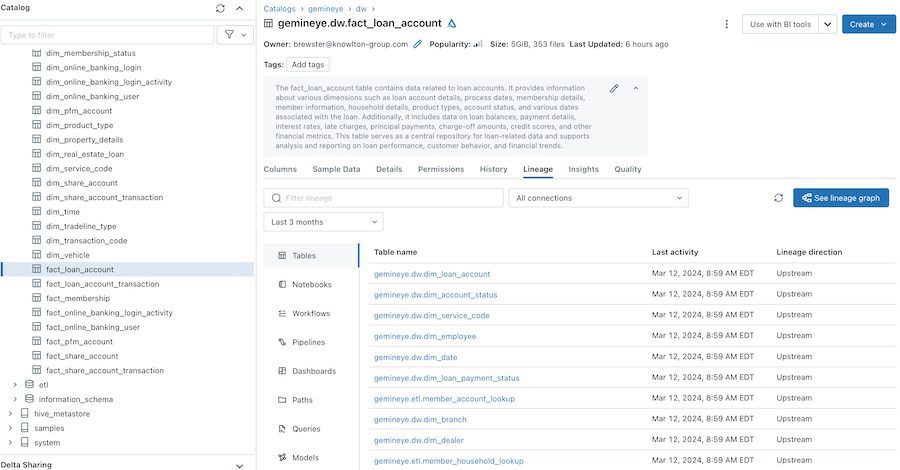

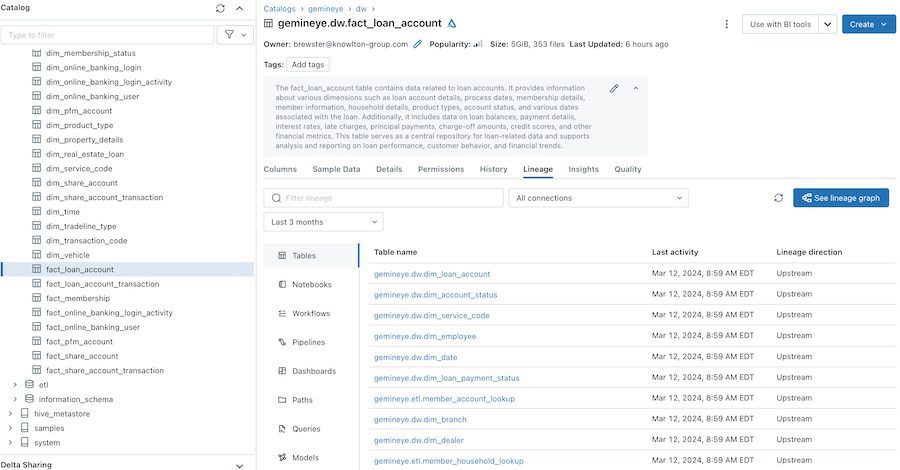

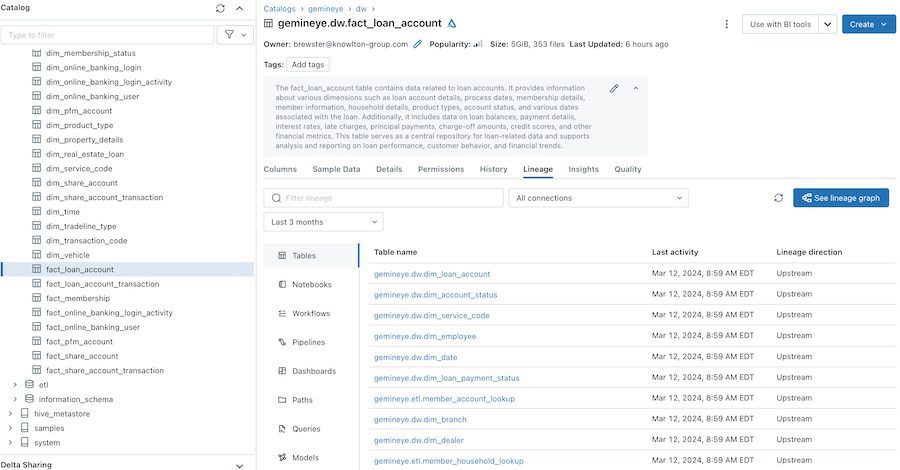

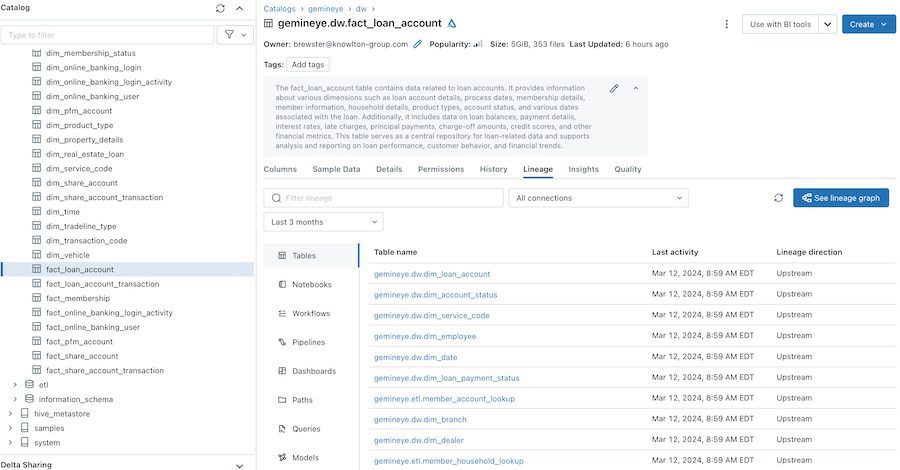

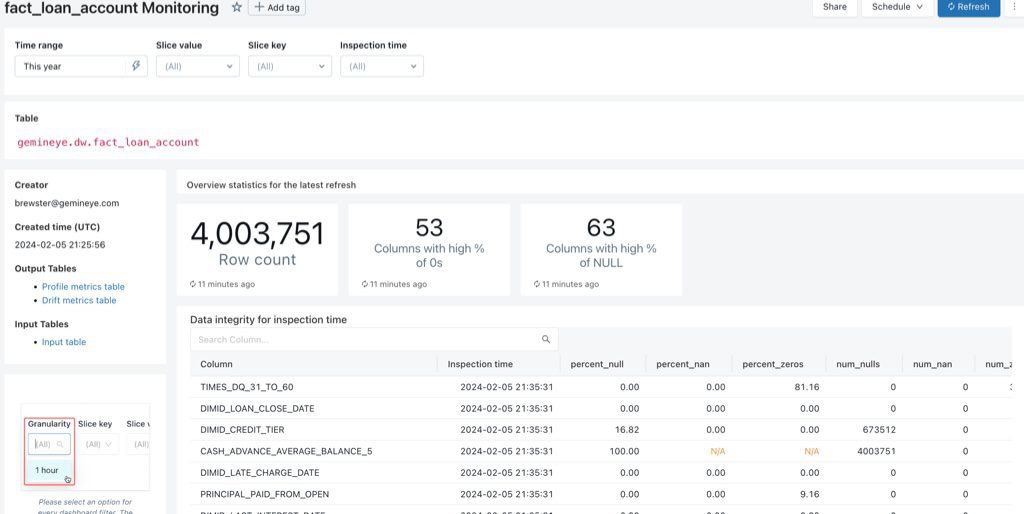

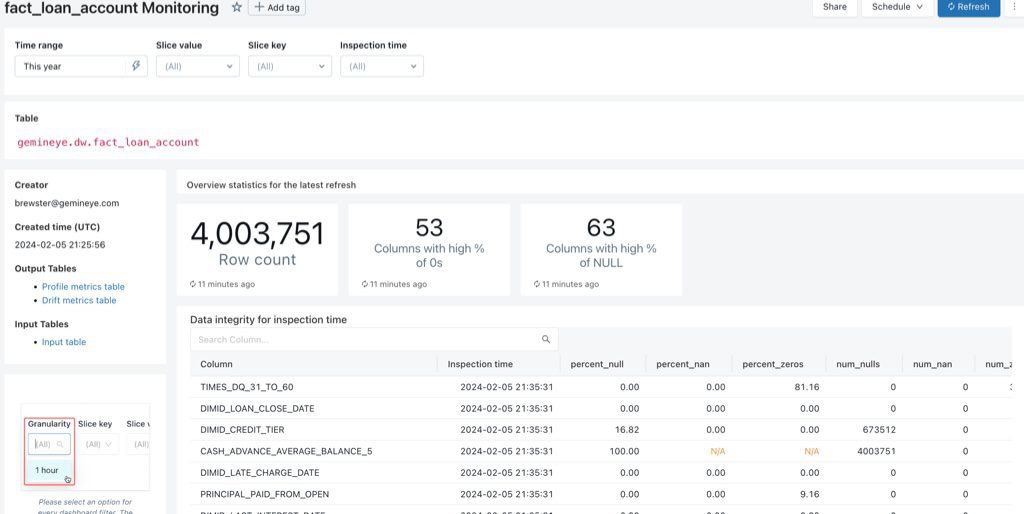

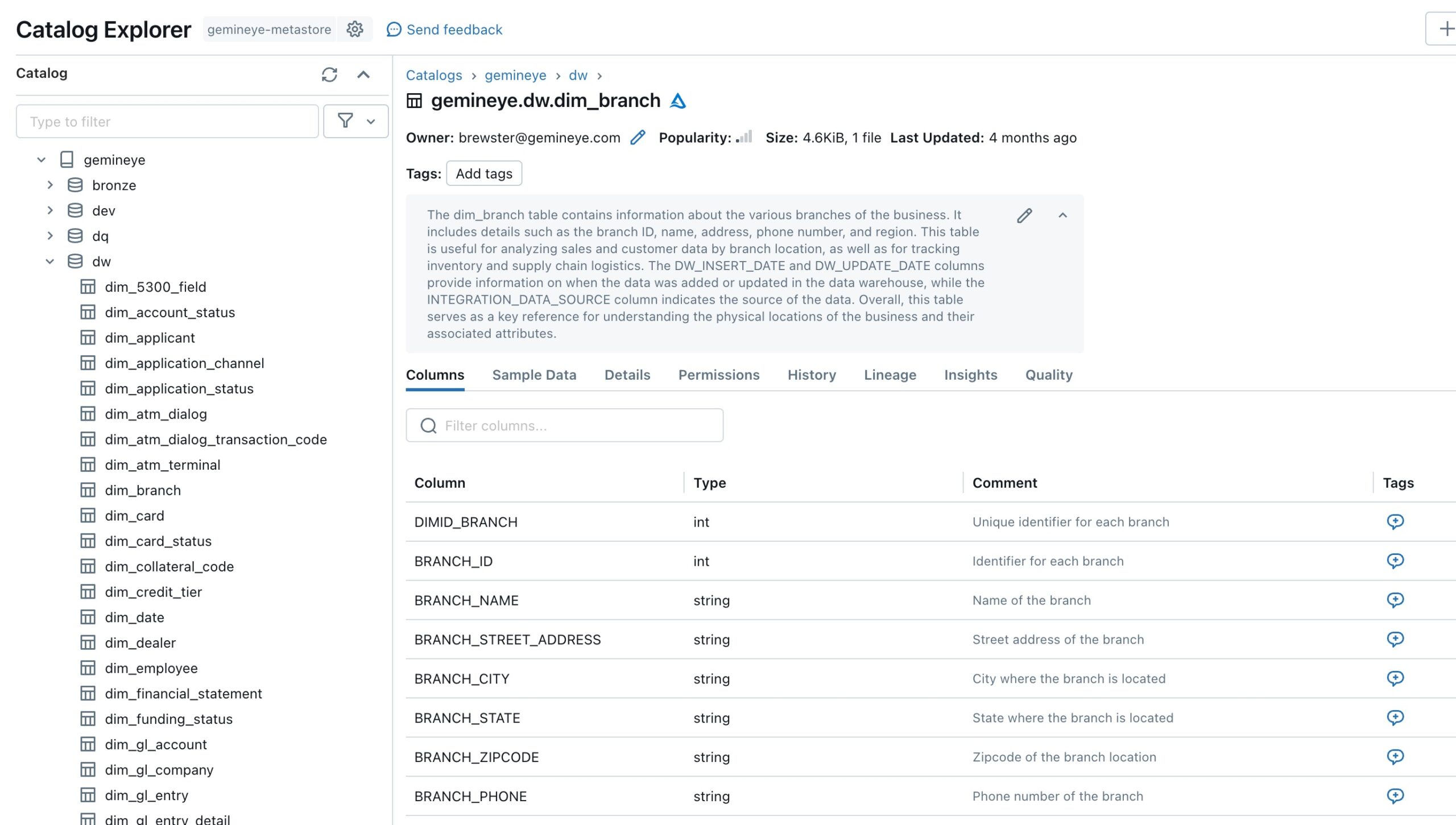

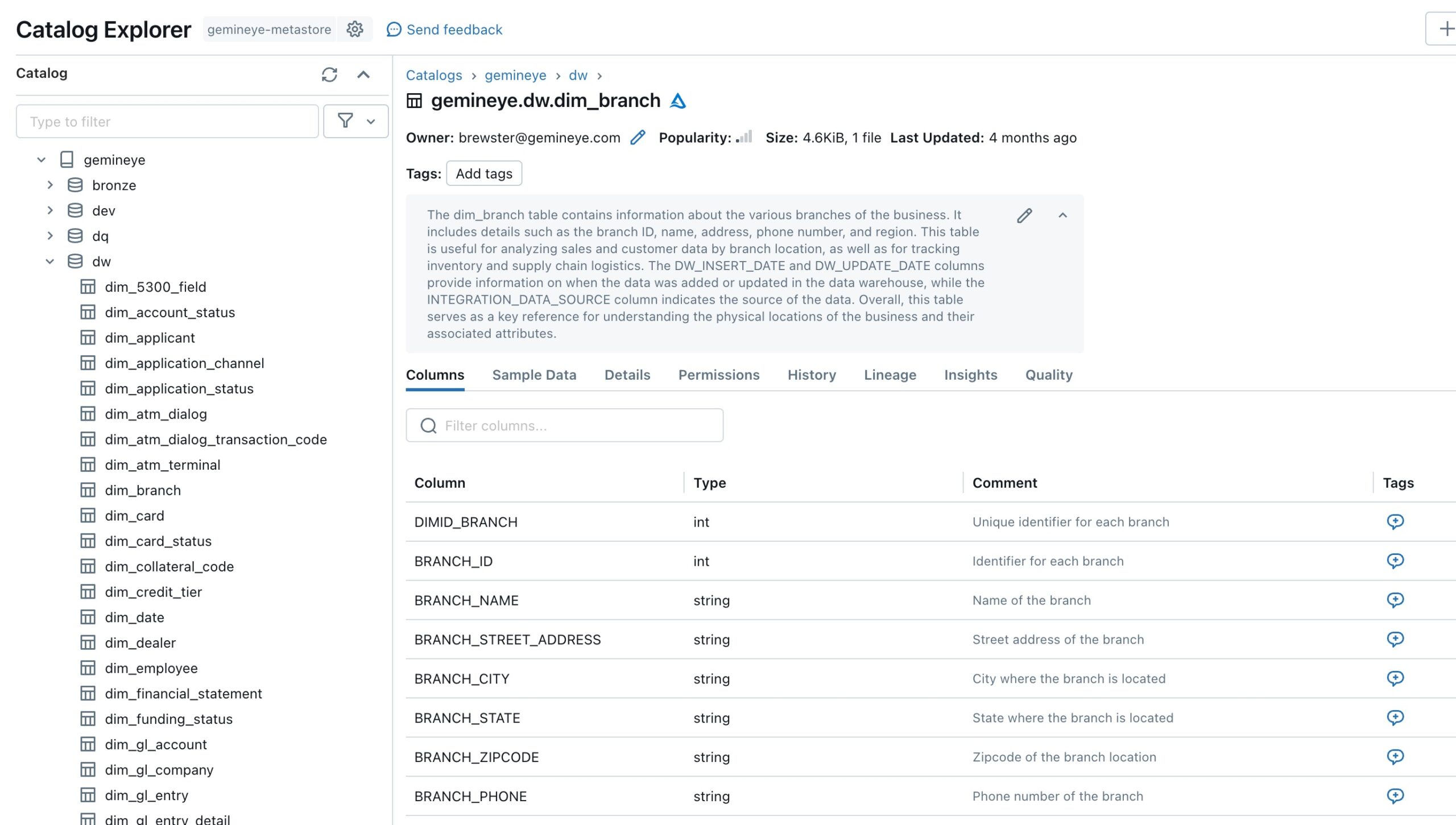

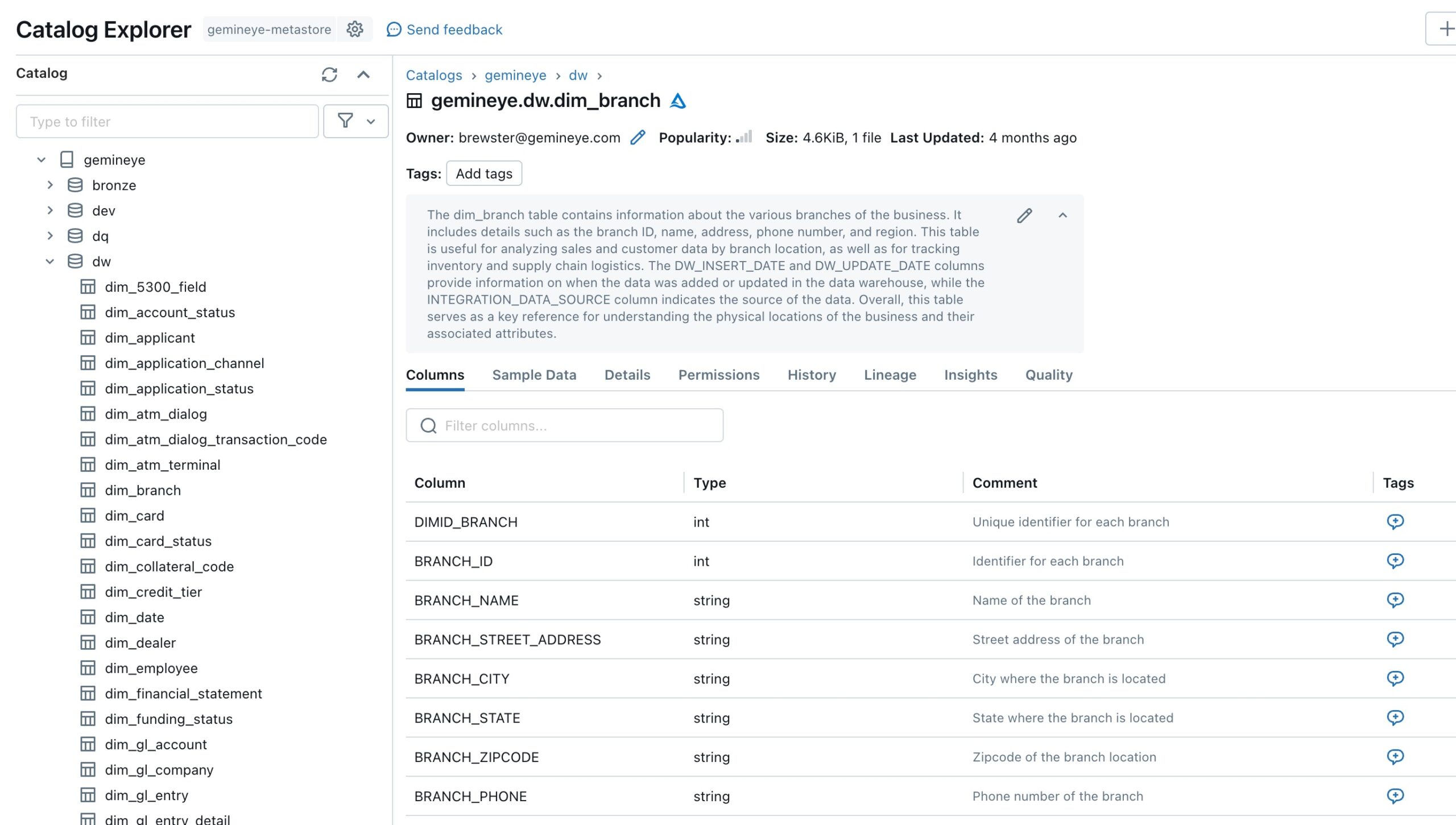

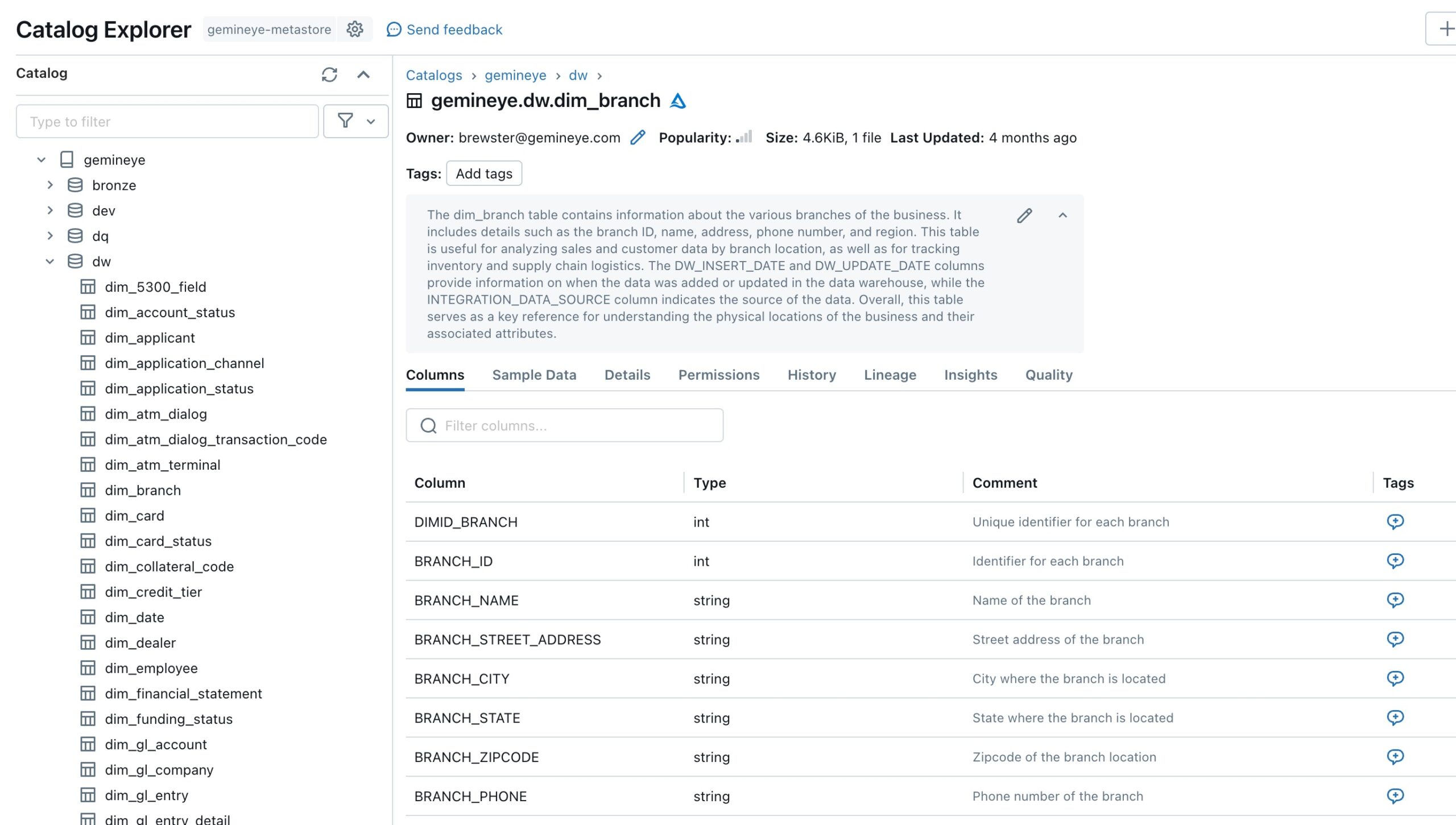

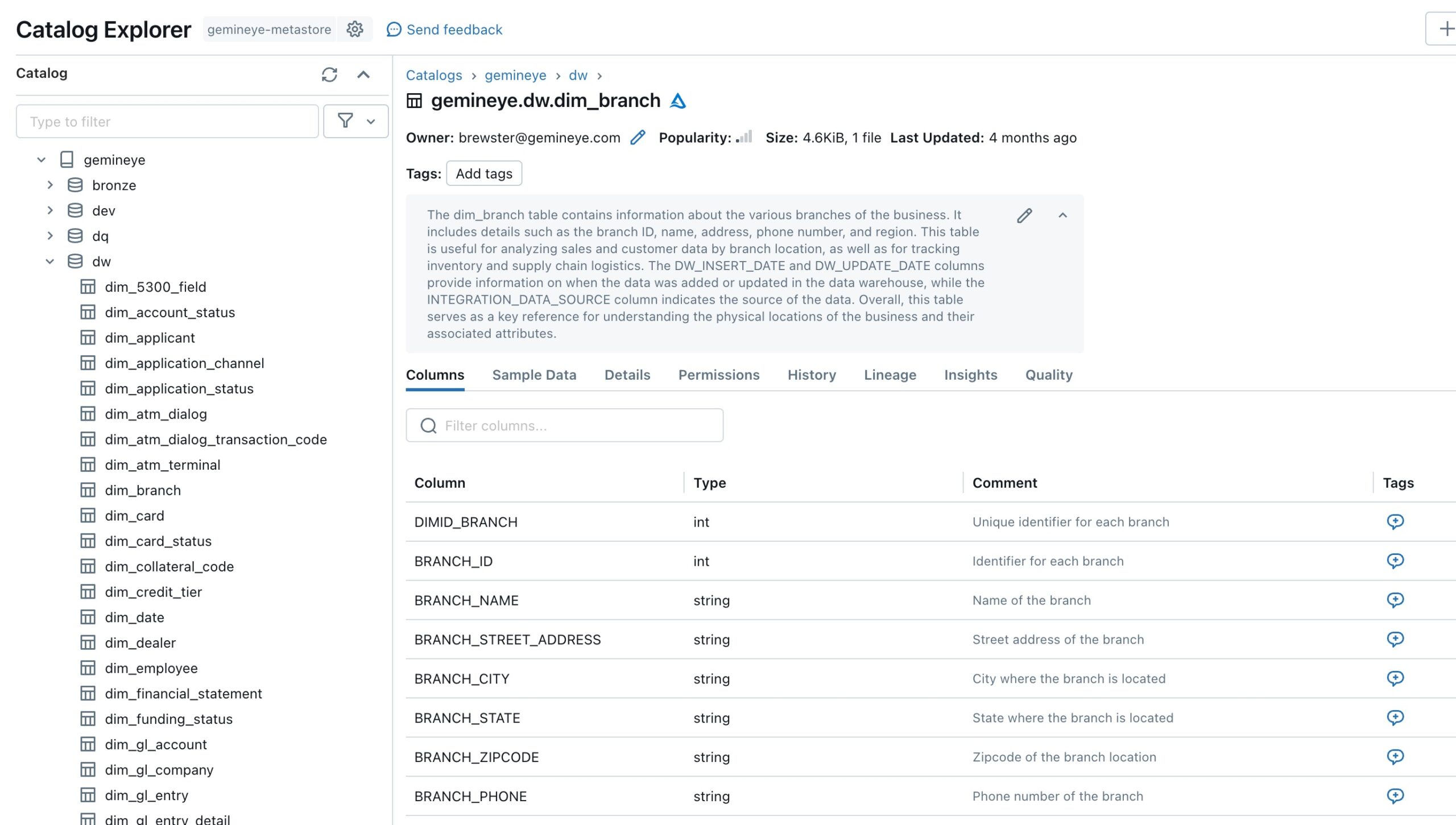

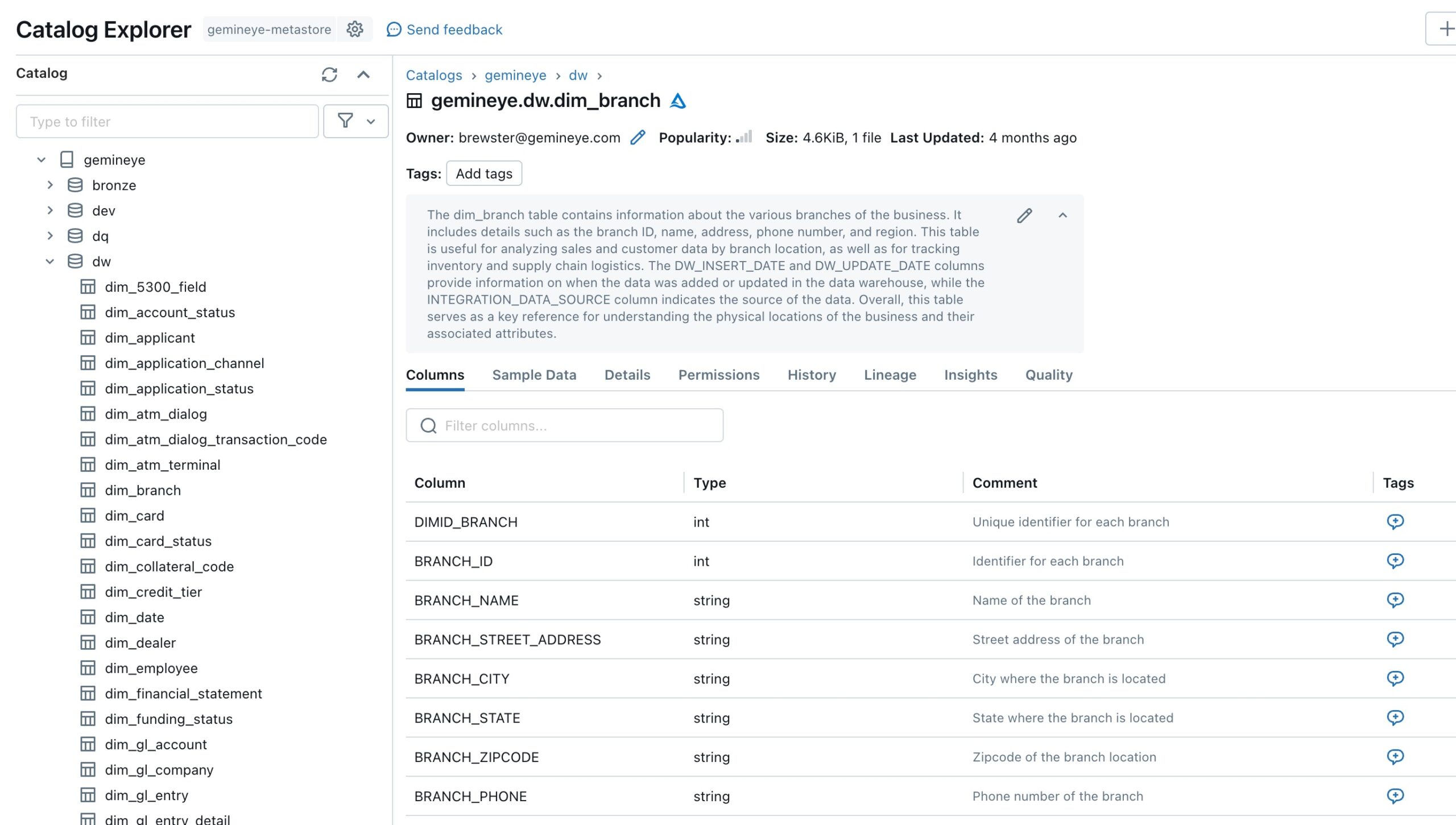

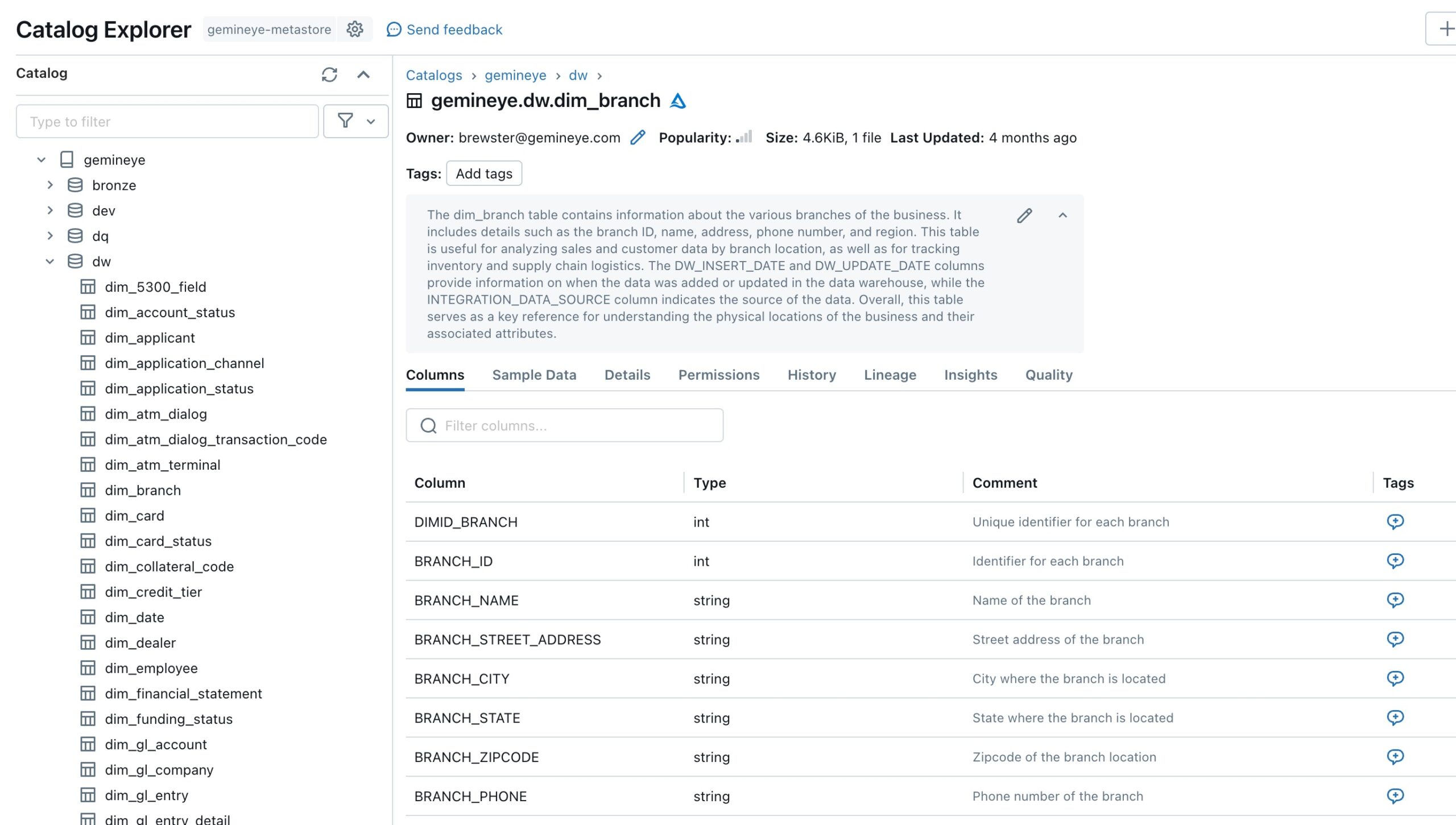

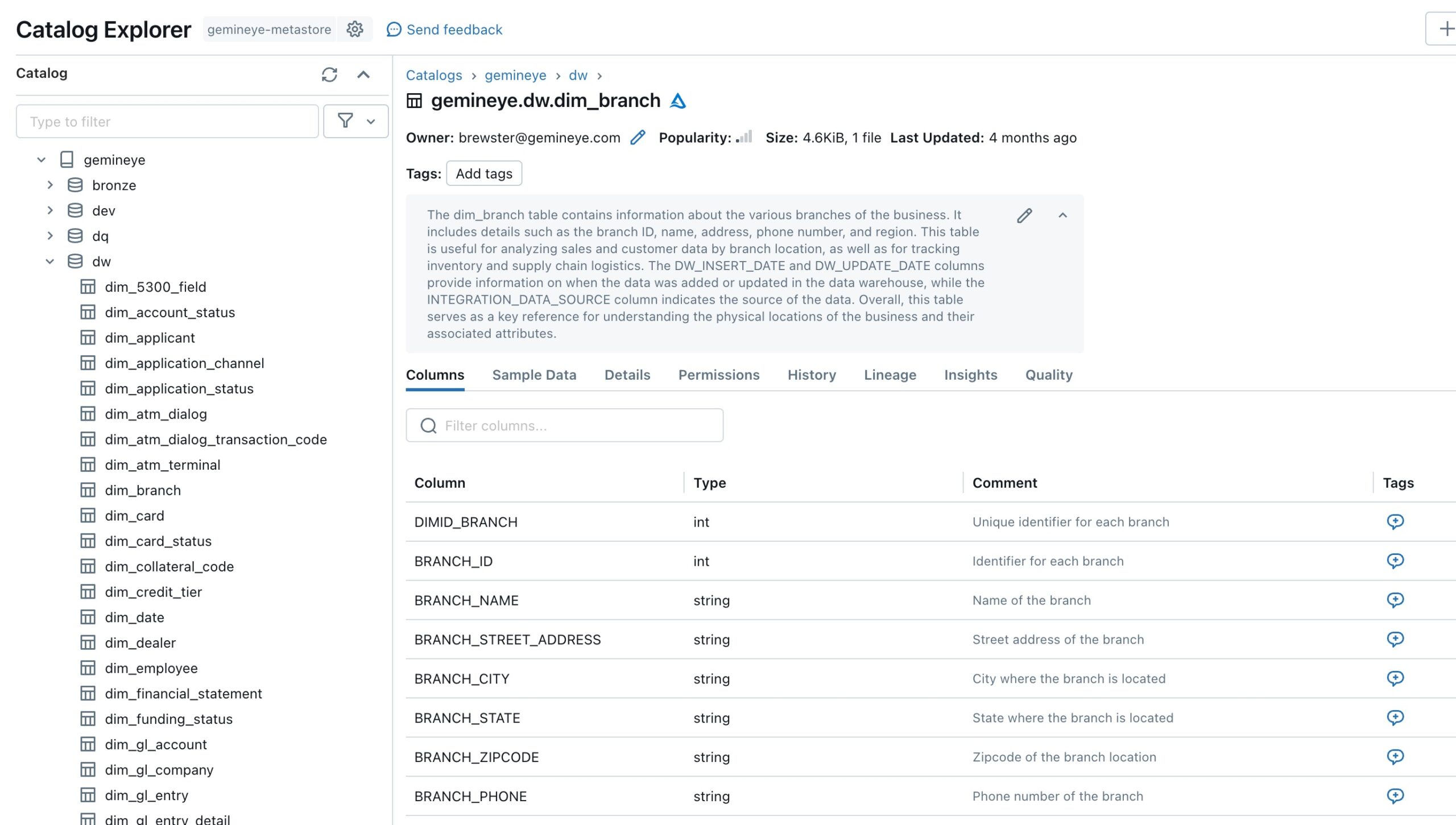

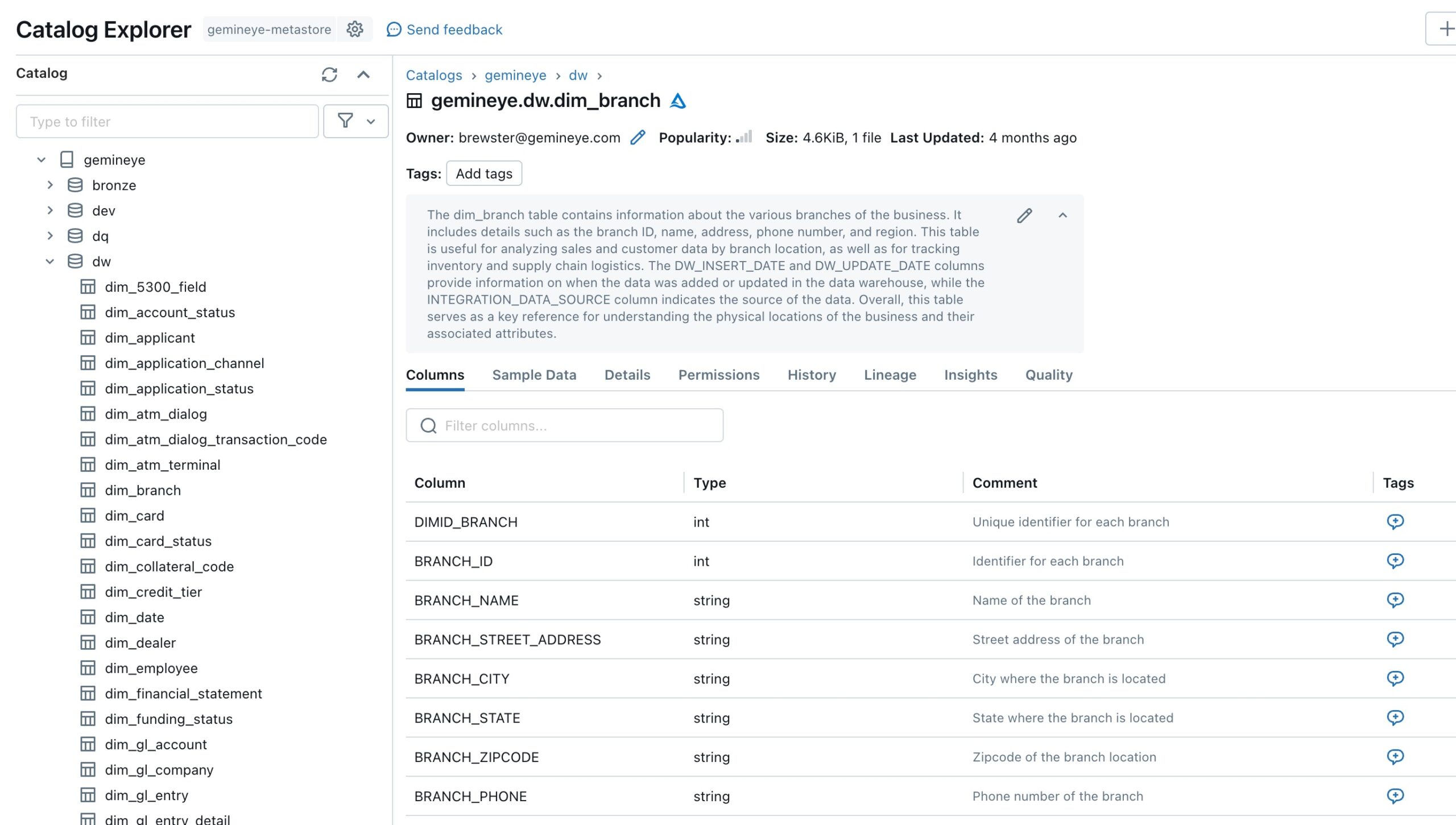

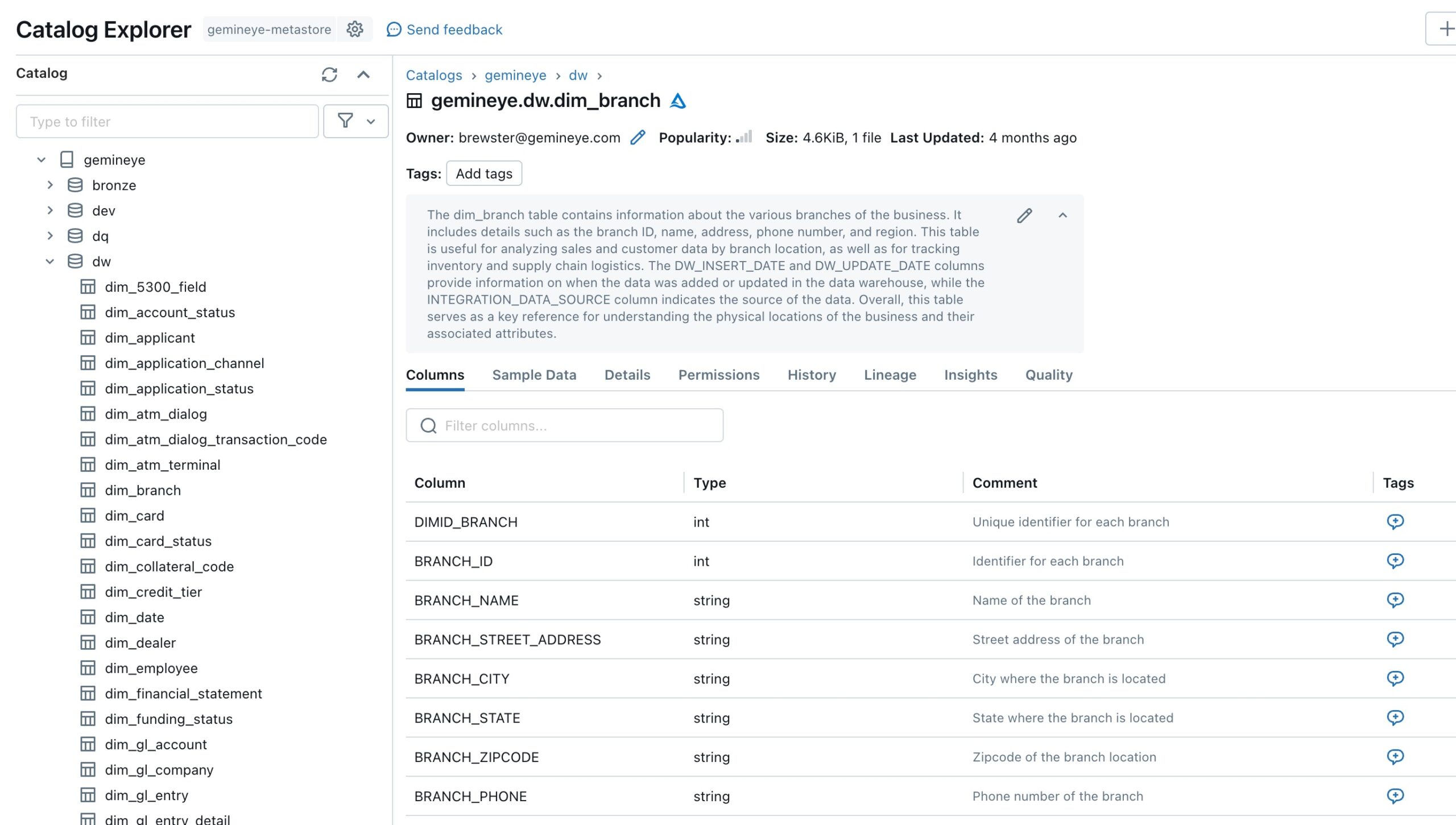

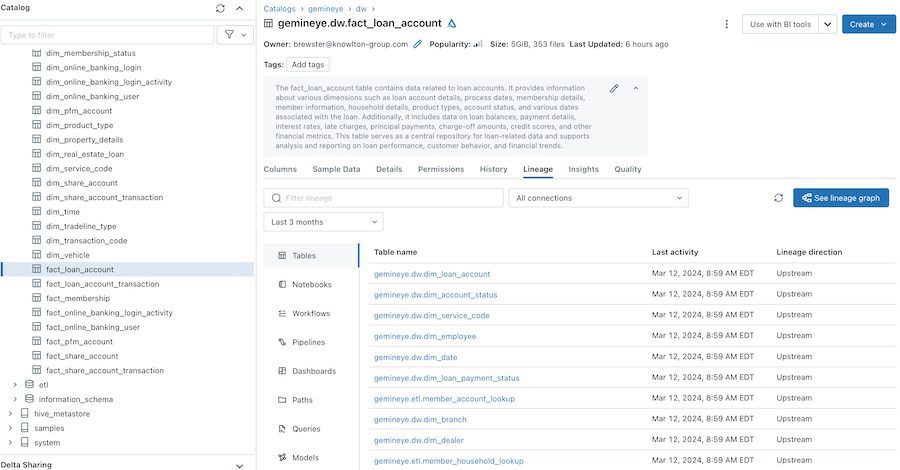

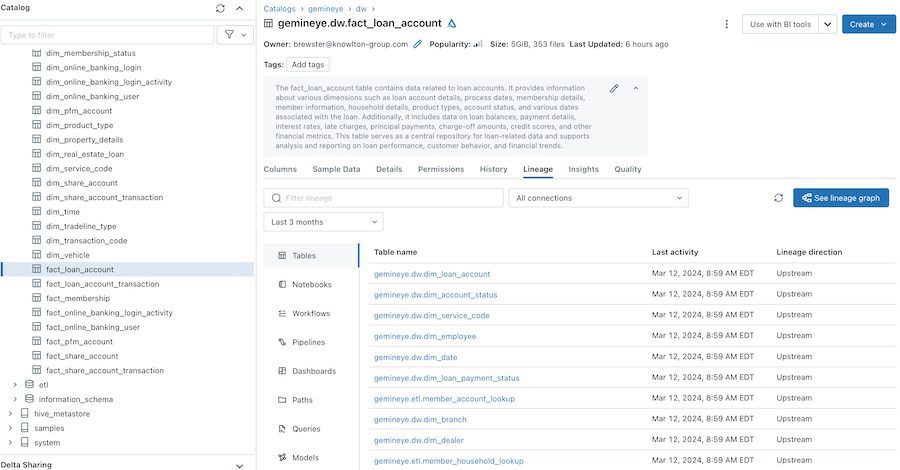

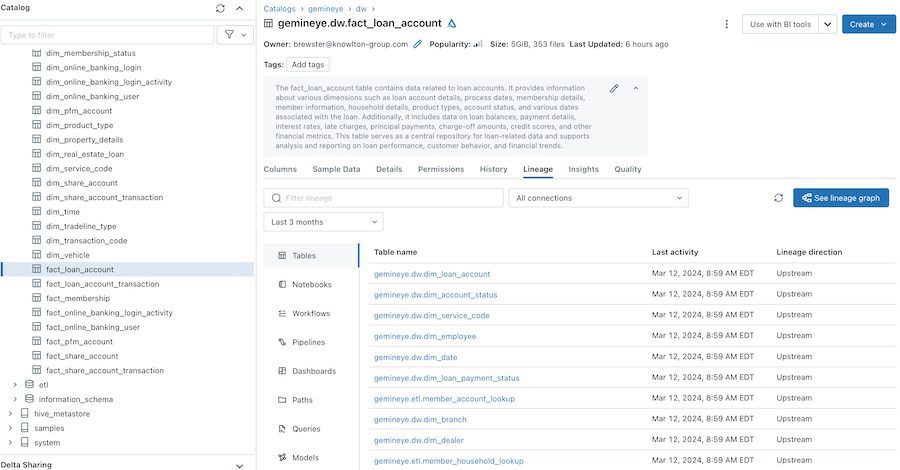

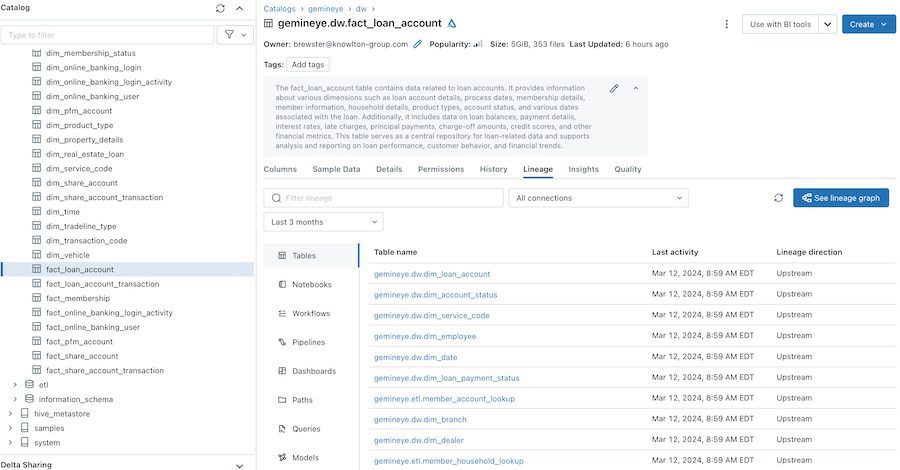

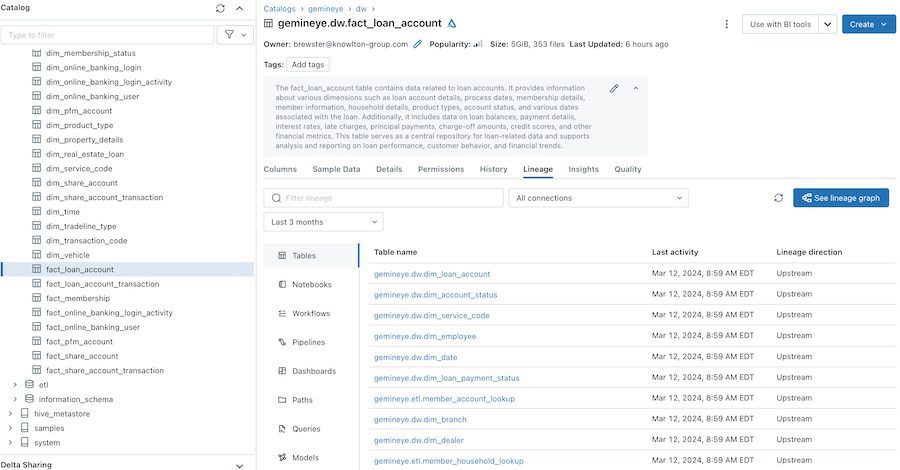

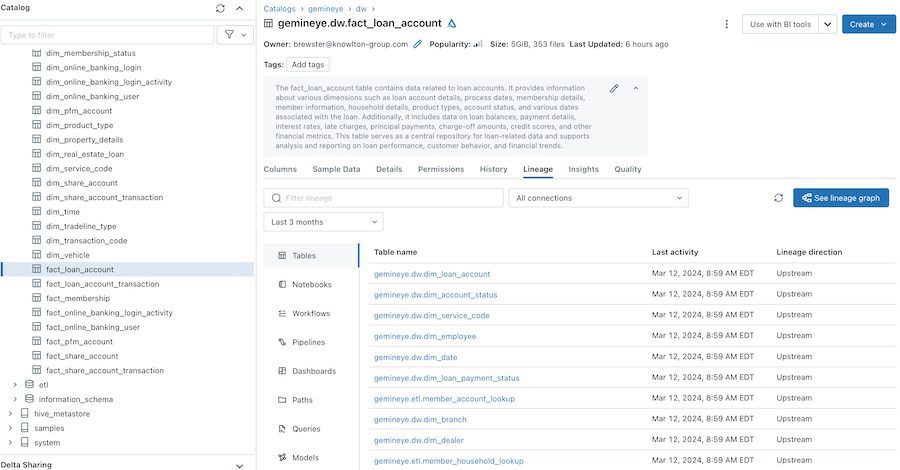

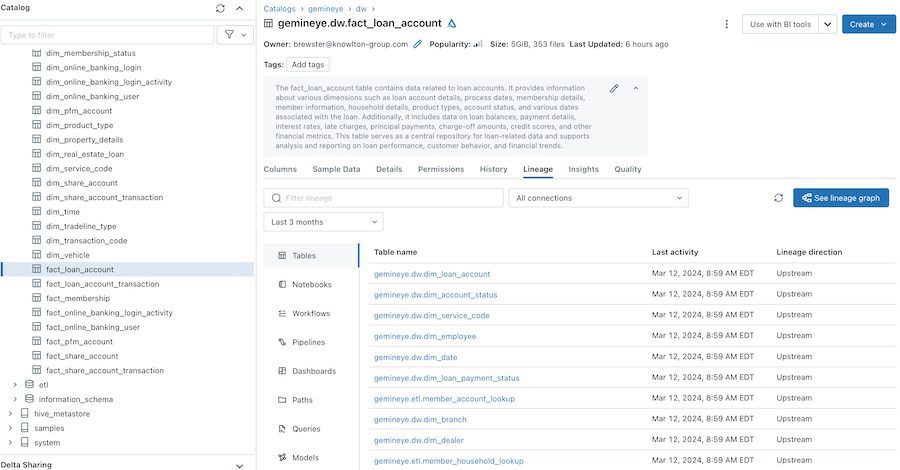

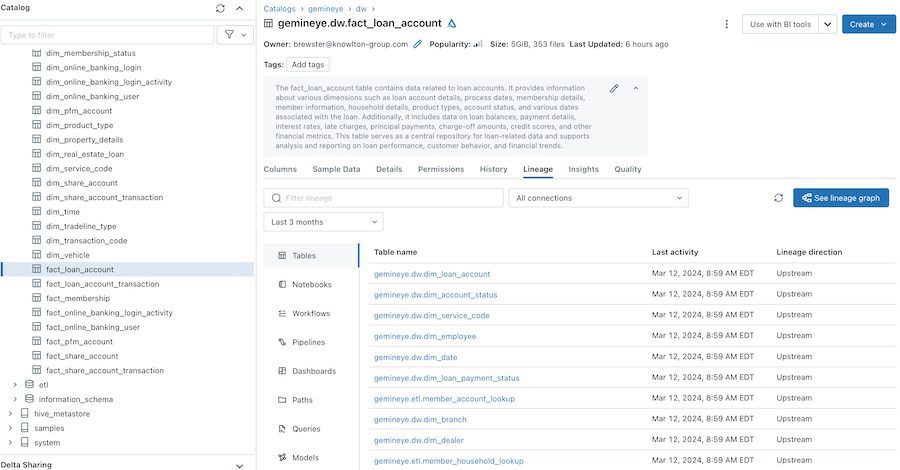

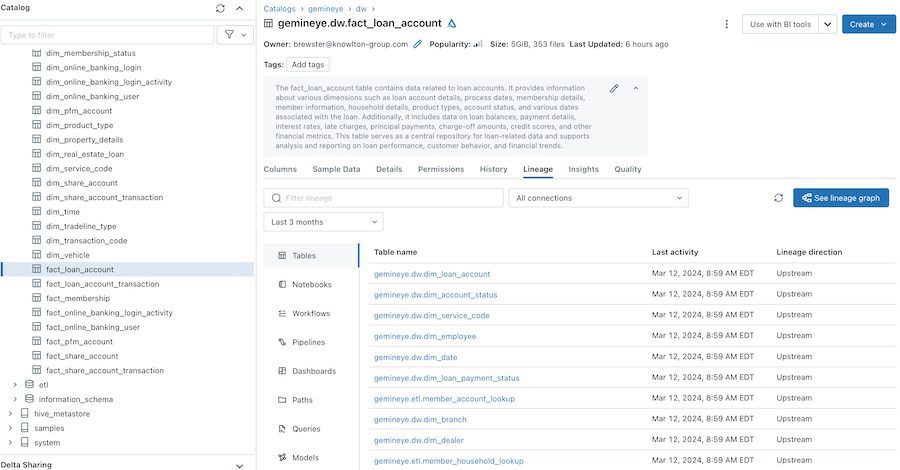

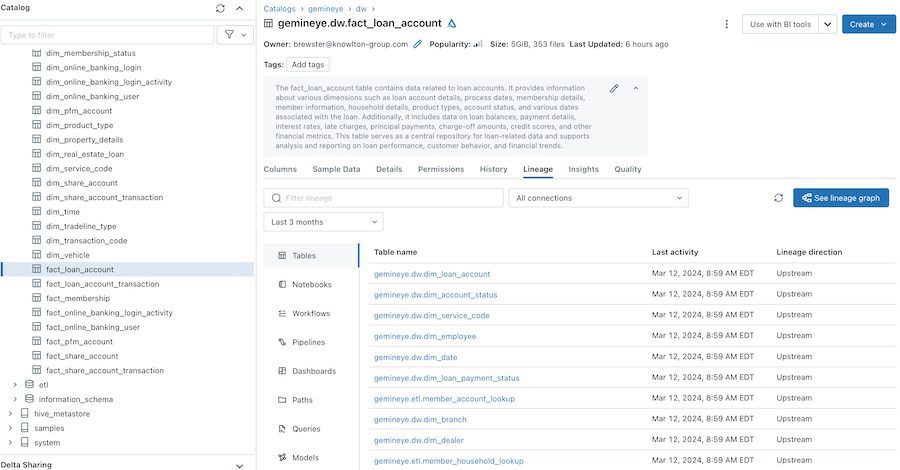

Transparent data dictionary

Data dictionary and mapping documents fully integrated into the solution and design to ensure your team knows exactly how all fields move from source to the data warehouse to the dashboards and reports.

Managing your data analytics program doesn’t have to be painful. From data governance to segmentation, conquer your data, no Advil needed.

It seems we can't find what you're looking for.

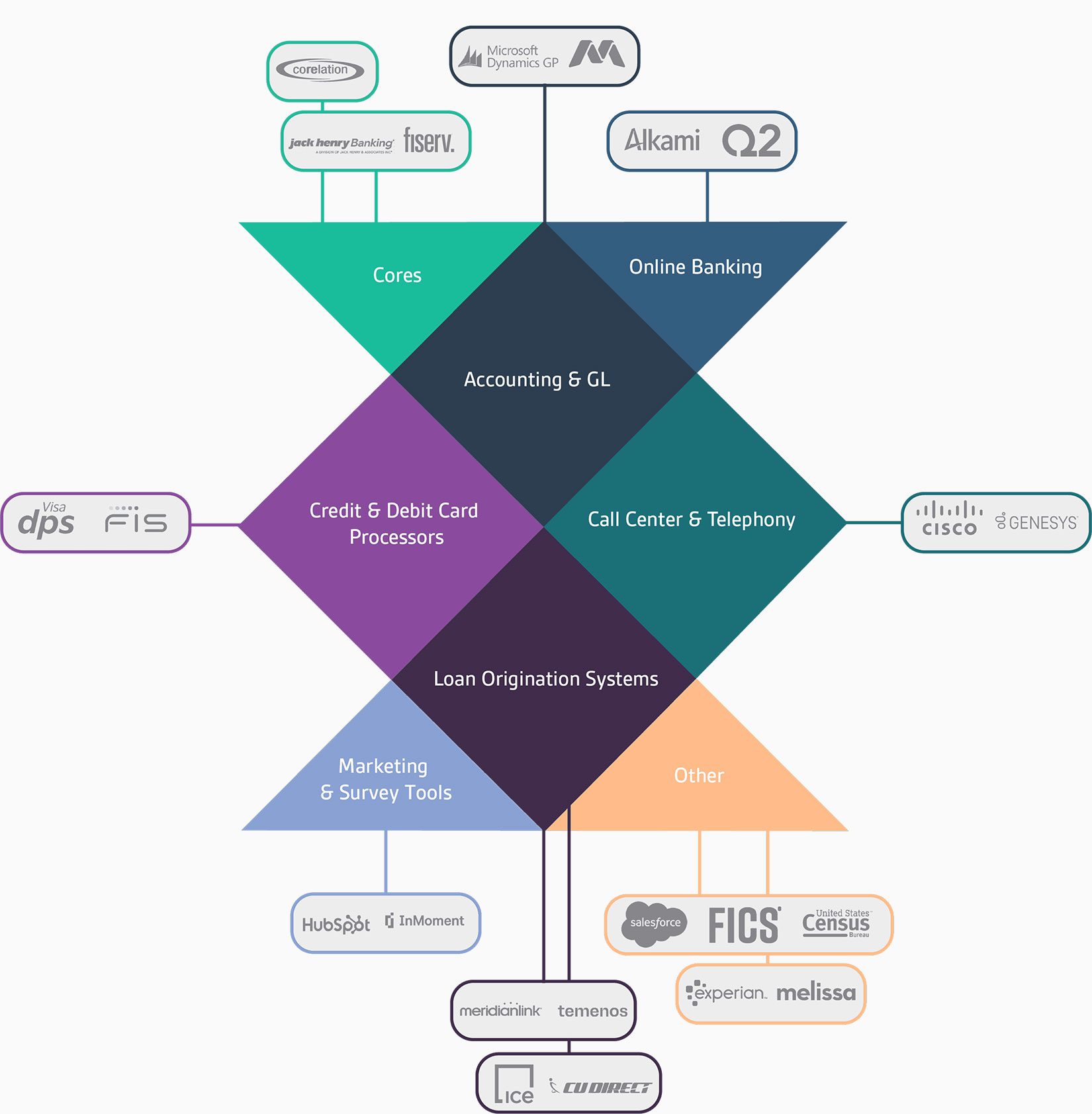

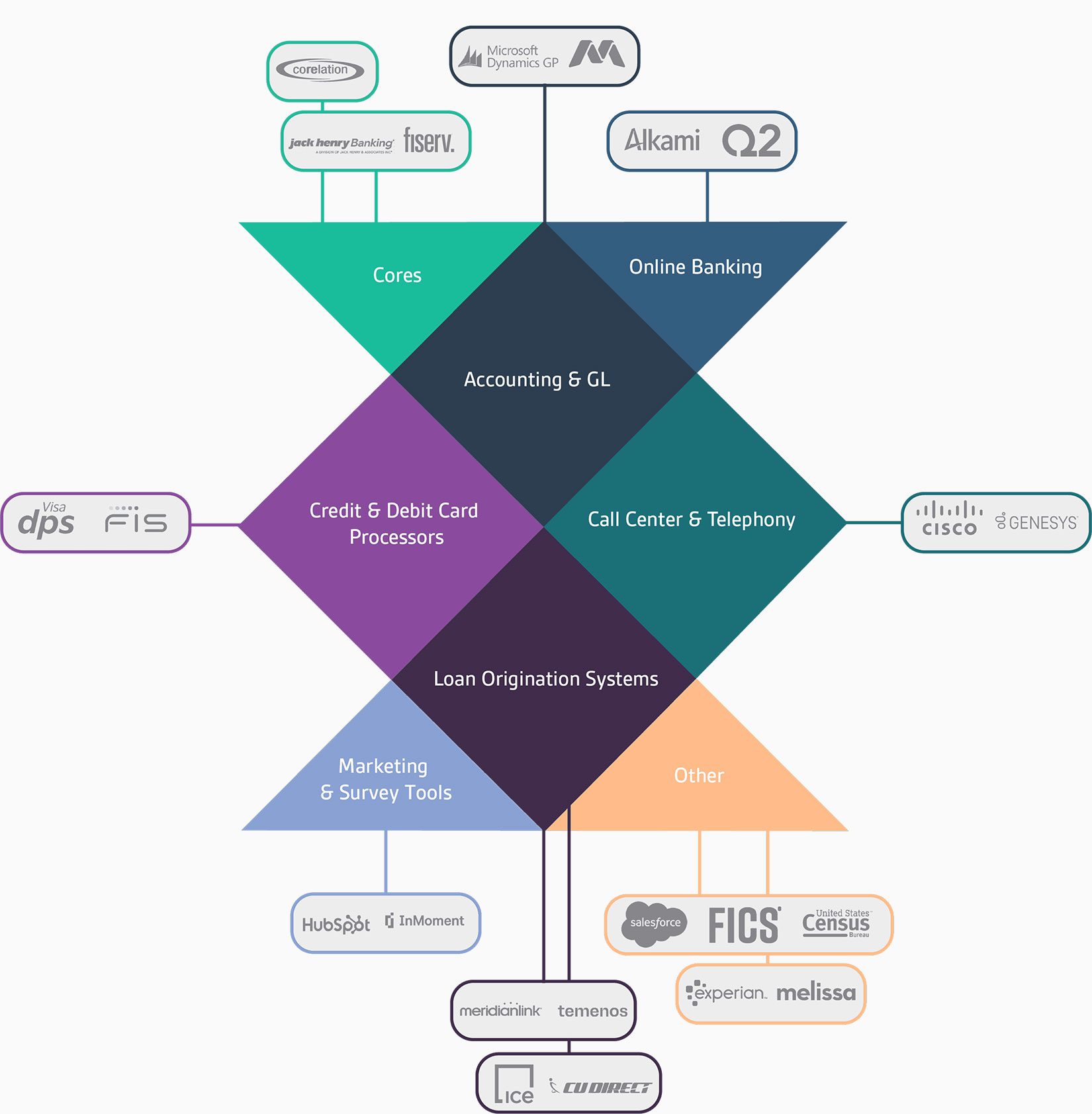

We currently support over 75 integrations – even the ones that other data analytics providers won’t touch. Our integrations incorporate leading credit union and bank solutions, like consumer loan and mortgage originations, digital banking, CRM / MRM, third-party data vendors, and more.

Their proficiency in leveraging Azure and Databricks technology is unparalleled. Gemineye not only possesses exceptional expertise but also proves to be an invaluable partner, wholeheartedly dedicated to aiding us in realizing our data analytics objectives.

We currently support over 75 integrations – even the ones that other data analytics providers won’t touch. Our integrations incorporate leading credit union and bank solutions, like consumer loan and mortgage originations, digital banking, CRM / MRM, third-party data vendors, and more.

If you’re old enough to remember the days of computer punch cards, floppy discs, or even CD-Roms, you know that data takes up space! Today we’ve gotten more efficient, and …

Picture it: Keanu Reeves and Sandra Bullock play an architect and a doctor who live 2 years apart in the same property and exchange letters over time… Wait, that’s …

If you’ve ever tried swimming in a data lake, you know what disappointment feels like. Not only is there no water (it’s bad for the computers), but those sharp …

In the financial world, your life is all about numbers. In the world of 21st century finance, it’s really all about data. Data was always key to the operations of your financial institutions. Think back 100 years and there would be filing cabinets full of vaults and ledgers and spreadsheets, all of which contained key customer information, statistics on bank performance, projections, etc. Today that data is all digital, and there’s infinitely more of it. Digitizing your organization over the past decades has meant that you can keep track of every piece of customer data, the success of every financial project, every single client interaction, every forecast – all in one place and all at immediate reach. No more running downtown to access a specific filing cabinet – today that data is everywhere and anywhere. So the question weighing on everyone’s minds is this: How is all of this data being controlled? What is being done to keep it safe and secure? The answer is data governance – how you’re using that data, how you control who has access to that data, and the policies that you have in place to make sure that it’s safe, secure, and used correctly. Your Data Governance Team You may already have dedicated individuals on your team to help curate your data, but if not, you’ll need to have those in place first. This can include a data governance committee, who helps build out the data governance framework and data policy, and data stewards who work with that data routinely and can help train others on best practices. However, good data governance is not reduced just to those individuals. Everyone plays a role in managing data properly. The entire team, no matter what their job description, should be trained on the organization’s data practice and how to stay compliant with them. It’s natural to expect the team to abide by those practices, and do everything possible to avoid any security breaches of sensitive data. Why is Data Governance Important? Why is data governance so important to your credit union or bank? The quality of your data is like an MRI of your business. If your data governance is weak, you may only be looking at an X-Ray, which gives you a partial image of what’s going on. Proper data governance means that you can get MRI results at any given time – a high-quality image that really shows you what’s happening behind the scenes from any given angle. Data governance is also crucial when it comes to looking forward. No financial institution remains stagnant – the goal is always to grow. Data is key to that forecasting, and can help make informed decisions about future products and offerings, better client support practices, and internal operational decisions. Data governance helps ensure that that data is secured, easily accessible, and used correctly to make those decisions. Don’t ever let your team feel like all of the data collected is simply going to waste! A Quick Look at Best Practices Here are a few things to remember as you take a closer look at how your organization handles data governance: Create a data driven culture. Help your team to understand that data isn’t simply top-down, but everyone on the team plays a role. Work towards measurable goals. Set benchmarks and targets like you would in any other part of operations, and celebrate reaching them. Know your rules and regulations. Compliance is everything, and you need to play within those rules and regulations in order to be truly successful. Train your team. Make sure that every hire, old and new, is well-familiar with your data governance policies and any new policies that you introduce. Invest in the right technology. Don’t throw good money after bad. Instead, look at your team’s needs, and find the right, customizable solution with the right integrations to get you there.

When running a financial institution you know that data is an important part of your operations. You’re regularly collecting customer (for our bank readers) and member (for our credit union readers) data from multiple points at once – customer personal information, transaction data, customer engagements, sales statistics on financial products – and you’re using it internally to move your operations forward. So why would any of that matter to your customers? There’s a common saying that “you’re only as good as your data.” This means that not only is it important to collect the data, but managing the data, organizing it in ways that are effective and efficient, and using it to better the customer experience. If you’re failing to take any one of those steps, you’re not providing your customers with the best possible service. Keep Your Data Clean One of the pillars to good data management is to keep your data clean. That means ensuring that the information that you have is fresh and current – no small feat when it comes to juggling sensitive information from thousands or even tens of thousands of customers, but crucial nonetheless. This can be as simple as taking past customers off of lists so that you’re not continually bombarding them with mail, phone calls, and emails that are unwanted. It also means removing deceased customers from lists so that their surviving family customers are not burdened with the same thing. Stop Overselling When was the last time that you received a piece of paper mail about a vehicle that you haven’t owned in 5 years, from a dealership that you went to once over a decade ago? That sort of thing is annoying to consumers, and it’s equally annoying to your customers, especially when they expect those who handle their money to have better data. Having outdated and messy data means that you’ll continue to send reminders about a car loan that’s closed, or a mortgage that has been paid off. Customers usually won’t alert you about these mistakes. Instead they’ll throw out your mail, delete your email, and be left with a sour taste in their mouths that no brand needs. Keeping your data current, and reviewing it regularly may not eliminate these problems every single time, but they will go a long way to ensure that you’re contacting the right customers about the right products and services. Stay Connected to Community If corporate social responsibility is among your priorities, then good data management will be crucial. It will guide you towards your customers’ interest, the priorities in their communities, and will show you exactly how and where you can help. Civic engagement is earnest, but a brand attempts to engage without forethought it can appear as tone deaf. Instead, let your data tell you where to invest your time and efforts, and what those priorities should be. It will speak volumes about your customers, and your next steps can show them just how much you care about what they care about.

Hear this: Jack Henry’s 2023 Strategic Priorities Benchmark Study found that 42% of credit unions ranked leveraging data for strategic insights as their number one strategic priority. As more small and mid-sized credit unions are taking their first dive into data-driven waters, and larger credit unions taking a hard look at their developing data culture, it’s critical to remember to assess. This three-step guide will help you evaluate your progress as you improve and expand your data-driven culture in 2024. We’ve also included client examples – which whitepapers rarely provide – to show real-world insights and help you compare your progress to others in your space.

We offer complimentary consultations – never pushy, always honest.

Solutions

Why Gemineye