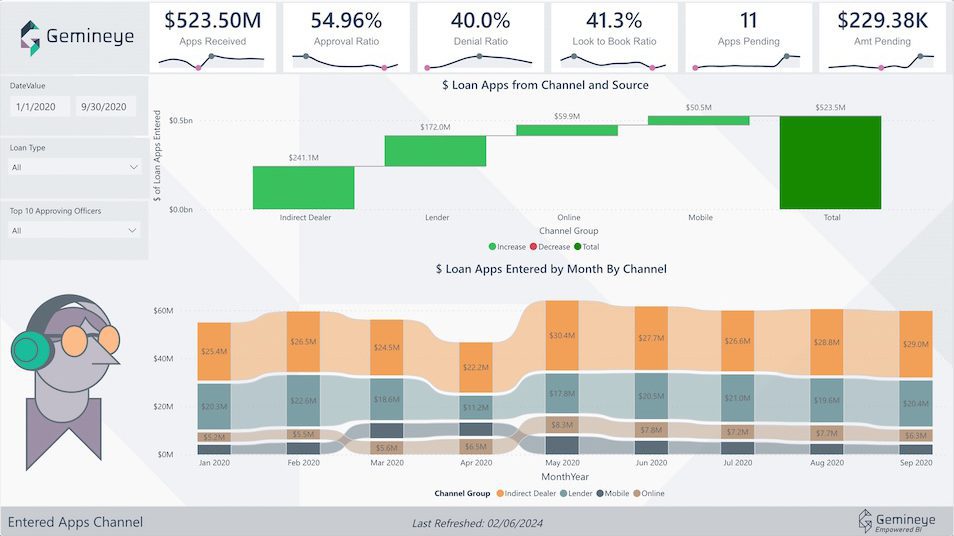

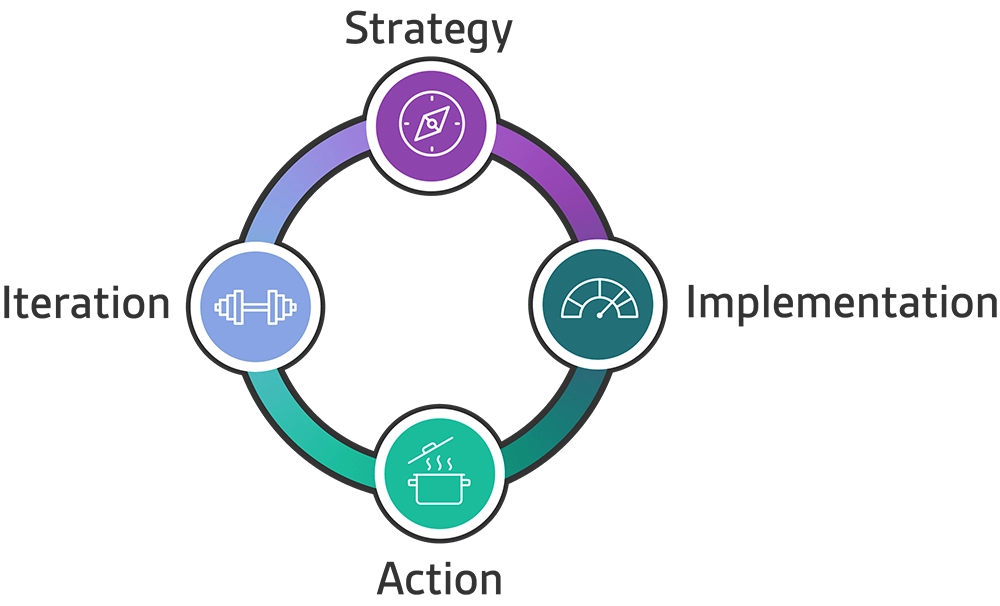

If you’re old enough to remember the days of computer punch cards, floppy discs, or even CD-Roms, you know that data takes up space! Today we’ve gotten more efficient, and we’re able to fit massive amounts of data into devices with microchips no larger than our fingernails. Yet when it comes to digital storage and data that lives online, we rarely give a second thought to where that data actually sits. If anything, most of us have a vague notion of ‘the cloud.’ We know that so much of our information today lives in ‘the cloud’ – this invisible entity that we picture floating all around us, but rarely do we give a second thought to what the cloud actually is, or how it works. We just presume that our data is stored safely somewhere until we get a warning from some watchdog telling us otherwise. In short, you’re….partially right. That data actually does live somewhere, even if that somewhere is within the cloud. Enter a data warehouse. So What is a Data Warehouse? A data warehouse today is basically the cloud-based version of a warehouse where a huge amount of data can be stored. It can be a warehouse for all of your historical data, from past reports, transactions and point-of-sale systems, customer forms, and other databases. It effectively consolidates all of this data, so that it’s easily categorized within one system, and easily searchable. Historically these data warehouses were hosted on-site on large mainframe computers, but today most live in the cloud. Much like a brick and mortar warehouse, these data warehouses usually contain several tools that help users navigate the data, such as comparing different data sets for analysis, as well as systems in place to help with categorizing, analysis, and reporting. Data warehouses are crucial when it comes to analytics and reporting. In order to truly understand the value of your financial services organization, you can’t just look at data taken from that day, that week, or even that same year. You need a historical picture that understands reporting over a lengthier period of time, and that’s where data warehouses can truly shine. Why Data Warehouses are Important If you’re doing any sort of business intelligence and analytics, you’re likely making use of a data warehouse. You may have access to the raw data from different sources and in different places, but putting them together into a format that gives you any insight is going to take significant time and resources. Instead, a data warehouse lets you extract the data, transform it ahead of time into more usable formats, and load it into the warehouse. Having a data warehouse is just one step of your greater data strategy. This can ensure that not only is your data consolidated in one place, but it’s done in a way that makes your data efficient, easily accessible, and a critical tool for your business analytics.